Question: Question 2-5 are together then question 9 QUESTION 2 Use the following information to answer the next 4 questions you want to buy an Adele

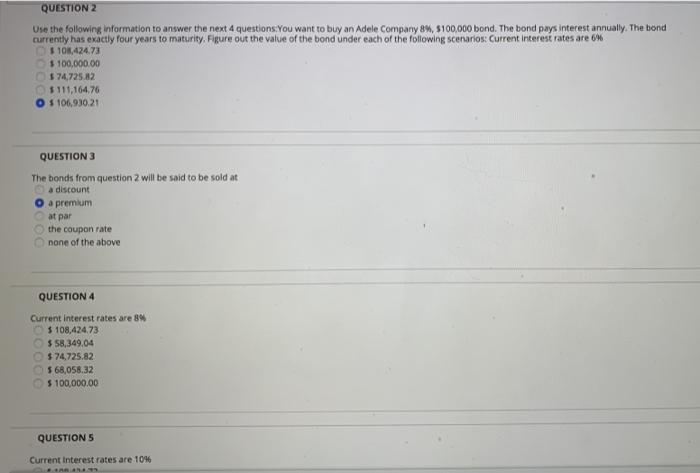

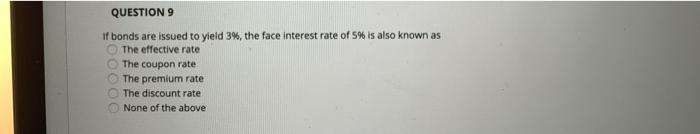

QUESTION 2 Use the following information to answer the next 4 questions you want to buy an Adele Company 8%, $100,000 bond. The bond pays interest annually. The bond currently has exactly four years to maturity. Figure out the value of the bond under each of the following scenarios: Current Interest rates are 64 $ 108,424.73 $100,000.00 $74,725.82 $ 111,164.76 O $ 106,930.21 QUESTION 3 The bonds from question will be said to be sold at a discount a premium at par the coupon rate none of the above QUESTION 4 Current interest rates are 8% $ 108,424.73 $ 58,349,04 $ 74,725.82 568,058.32 $ 100,000.00 QUESTION Current Interest rates are 1046 QUESTIONS Current Interest rates are 10% $ 108,424.73 $ 100,000.00 $ 93,660.27 $ 62,092.13 $ 92,418.43 QUESTION 9 If bonds are issued to yield 3%, the face interest rate of 5% is also known as The effective rate The coupon rate The premium rate The discount rate None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts