Question: Question 25 How much is 1/5 + 1/4 - 4/5 ? O A. 7/20 O B.-7/20 O c.0.35 O D.-2/20 lo another question will save

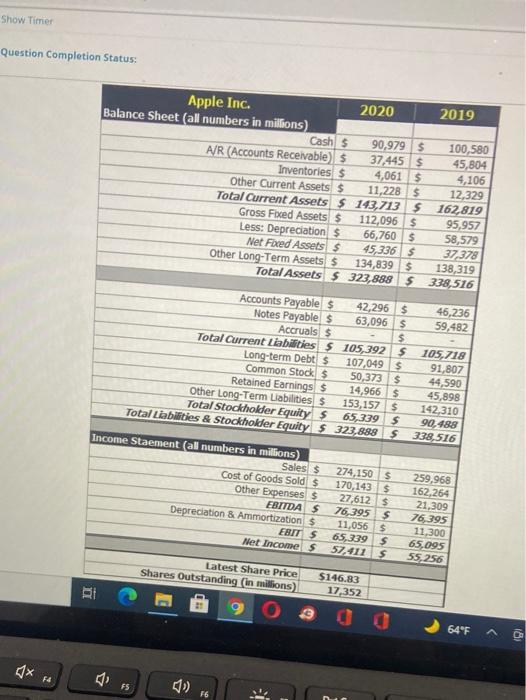

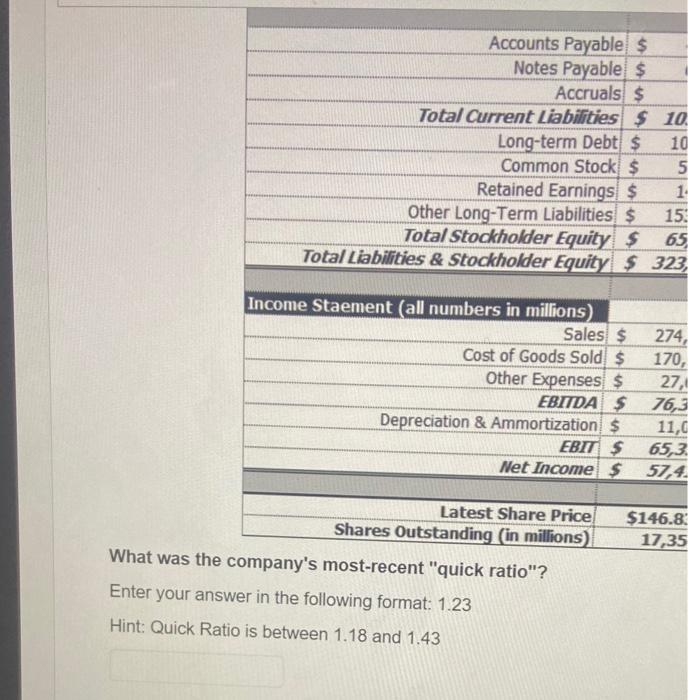

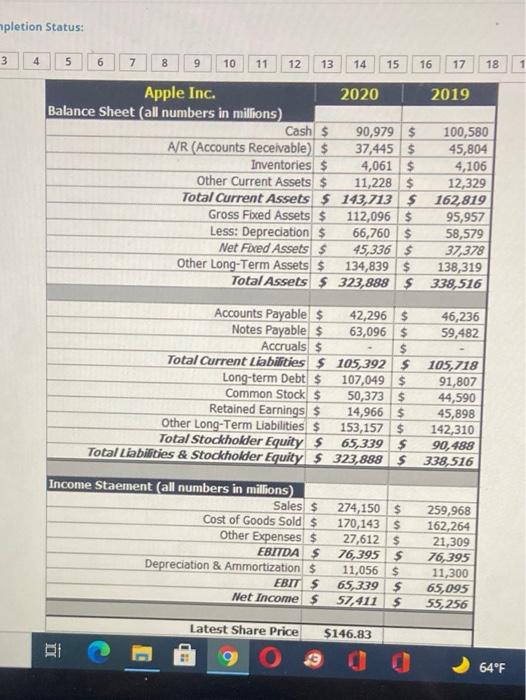

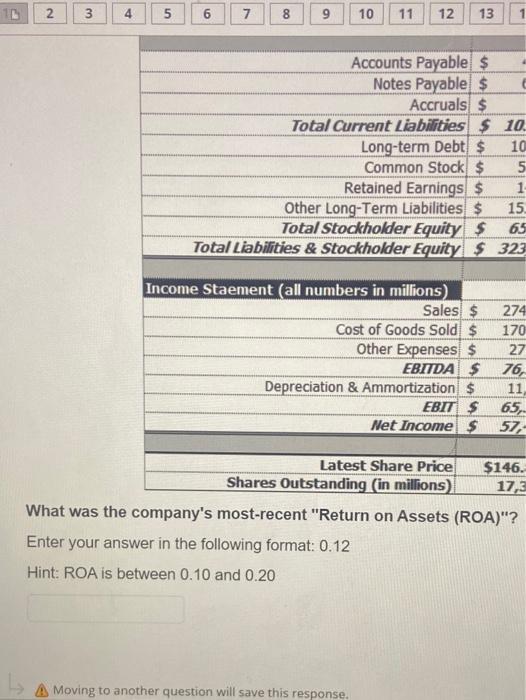

Question 25 How much is 1/5 + 1/4 - 4/5 ? O A. 7/20 O B.-7/20 O c.0.35 O D.-2/20 lo another question will save this response. Question 24 If cx d = 0, then which of the following statement is right? O A. C = 0 OB.d = 0 O c. both cand d must be zero. O D. Either cord, or both of them must be 0. Show Timer Question Completion Status: Apple Inc. 2020 2019 Balance Sheet (all numbers in millions) Cash $ 90,979 $ 100,580 A/R (Accounts Receivable) $ 37.4455 45,804 Inventories $ 4,061 4,106 Other Current Assets $ 11,2285 12,329 Total Current Assets $ 143,713 $ 162,819 Gross Foxed Assets 112,096 $ 95,957 Less: Depreciation $ 66,760$ 58,579 Net Food Assets $ 45,3365 37 378 Other Long-Term Assets $ 134,839 $ 138,319 Total Assets $ 323,888 S 338,516 Accounts Payable 42,296 $ 46,236 Notes Payable $ 63,096 59,482 Accruals $ Total Current Liabilities $ 105,392 S 105,718 Long-term Debts 107,049 $ 91,807 Common Stock $ 50,373 $ 44,590 Retained Earnings 14,966 $ 45,898 Other Long-Term Liabilities 153,157 $ 142.310 Total Stockholder Equity s 65,339 5 90, 188 Total Liabilities & Stockholder Equity 5 323,8885 338,516 Income Staement (al numbers in millions) Sales $ Cost of Goods Sold $ Other Expenses EBITDA 5 Depreciation & Ammortizations EBITS Net Income s 274,150 $ 170,1435 27,612 $ 76,395 $ 11,0565 65,339 $ 57.411 S 259,968 162,264 21,309 76,395 11,300 65,095 55,256 Latest Share Price Shares Outstanding in millions) $146.83 17,352 64F 18 F4 F5 76 Accounts Payable $ Notes Payable $ Accruals $ Total Current Liabilities $ 10. Long-term Debt $ 10 Common Stock $ 5 Retained Earnings $ 1 Other Long-Term Liabilities $ 15: Total Stockholder Equity $ 65 Total Liabilities & Stockholder Equity $ 323, il 170, Income Staement (all numbers in millions) Sales $ 274, Cost of Goods Sold $ Other Expenses $ 27, EBITDA 5 76,3 Depreciation & Ammortization! $ 11,0 EBIT $ 65,3 Net Income $ 57,4. $146.80 17,35 Latest Share Price Shares Outstanding (in millions) What was the company's most-recent "quick ratio"? Enter your answer in the following format: 1.23 Hint: Quick Ratio is between 1.18 and 1.43 pletion Status: 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Apple Inc. 2020 2019 Balance Sheet (all numbers in millions) Cash $ 90,979 $ 100,580 A/R (Accounts Receivable) $ 37,445$ 45,804 Inventories $ 4,061 $ 4,106 Other Current Assets 11,228 $ 12,329 Total Current Assets $ 143,713 S 162,819 Gross Fixed Assets 112,096 $ 95,957 Less: Depreciations 66,760 $ 58,579 Net Fixed Assets s 45,336 $ 37,378 Other Long-Term Assets $134,839 $ 138,319 Total Assets 323,888 $ 338,516 Accounts Payable $ 42,296 $ 46,236 Notes Payable $ 63,096 $ 59,482 Accruals $ $ Total Current Liabilities $ 105,392 $ 105,718 Long-term Debt $ 107,049 $ 91,807 Common Stock $ 50,373 $ 44,590 Retained Earnings $ 14,966 $ 45,898 Other Long-Term Liabilities $ 153,157 $ 142,310 Total Stockholder Equity s 65,339 $ 90,488 Total Liabilities & Stockholder Equity 5 323,888 S 338,516 Income Staement (all numbers in millions) Sales $ 274,150 $ 259,968 Cost of Goods Sold $ 170,1435 162,264 Other Expenses $ 27,612 $ 21,309 EBITDA S 76,395 S 76,395 Depreciation & Ammortizations 11,056 $ 11,300 EBIT S 65,339 $ 65,095 Net Income S 57,411 5 55, 256 Latest Share Price $146.83 RE 64F N 3 4 5 6 7 00 9 9 10 11 12 13 Accounts Payable $ Notes Payable $ Accruals $ Total Current Liabilities $ 10 Long-term Debt $ 10 Common Stock $ 5 Retained Earnings $ 1 Other Long-Term Liabilities $ 15 Total Stockholder Equity $ Total Liabilities & Stockholder Equity $ 323 65 Income Staement (all numbers in millions) Sales $ Cost of Goods Sold: $ Other Expenses $ EBITDA $ Depreciation & Ammortization $ EBIT $ Net Income! $ 274 170 27 76, 11 65, 57, Latest Share Price $146. Shares Outstanding (in millions) 17,3 What was the company's most-recent "Return on Assets (ROA)"? Enter your answer in the following format: 0.12 Hint: ROA is between 0.10 and 0.20 A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts