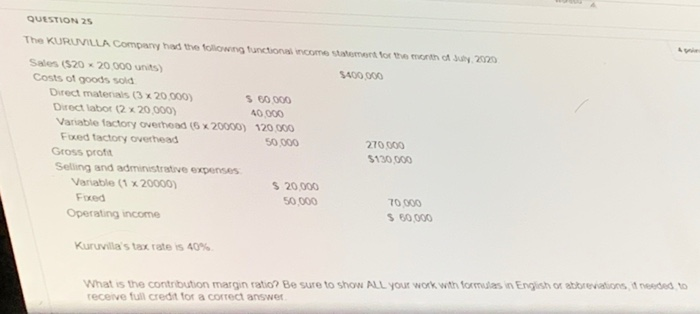

Question: Question 25 Need help please. show work *going to have to zoom in* QUESTION 25 The KURUVILLA Company has the following functional income talent for

QUESTION 25 The KURUVILLA Company has the following functional income talent for the mothy 2020 Sales (520 x 20 000 units) S400.000 Costs of goods sold Direct materials (3 x 20.000) S80 000 Direct labot (2 x 20 000) 40.000 Variable factory overhead (6 x 20000) 120.000 Fixed factory overhead 50.000 270 000 Gross prota 5130.000 Selling and administrative expenses Variable (1 x 20000) $ 20.000 Foxed 50.000 70.000 Operating income $ 80.000 Kuruvilla's tax rate is 40% What is the contribution margin ratio? Be sure to show ALL YOUt work with formulas in English or abbreviations needed to receive full credit for a correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts