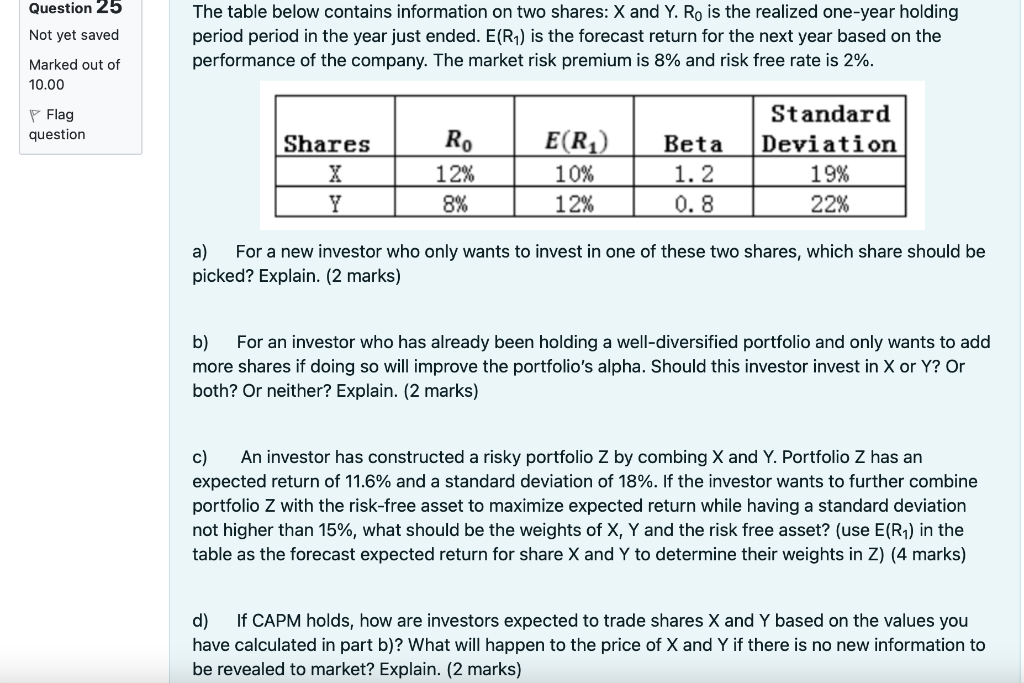

Question: Question 25 Not yet saved The table below contains information on two shares: X and Y. Ro is the realized one-year holding period period in

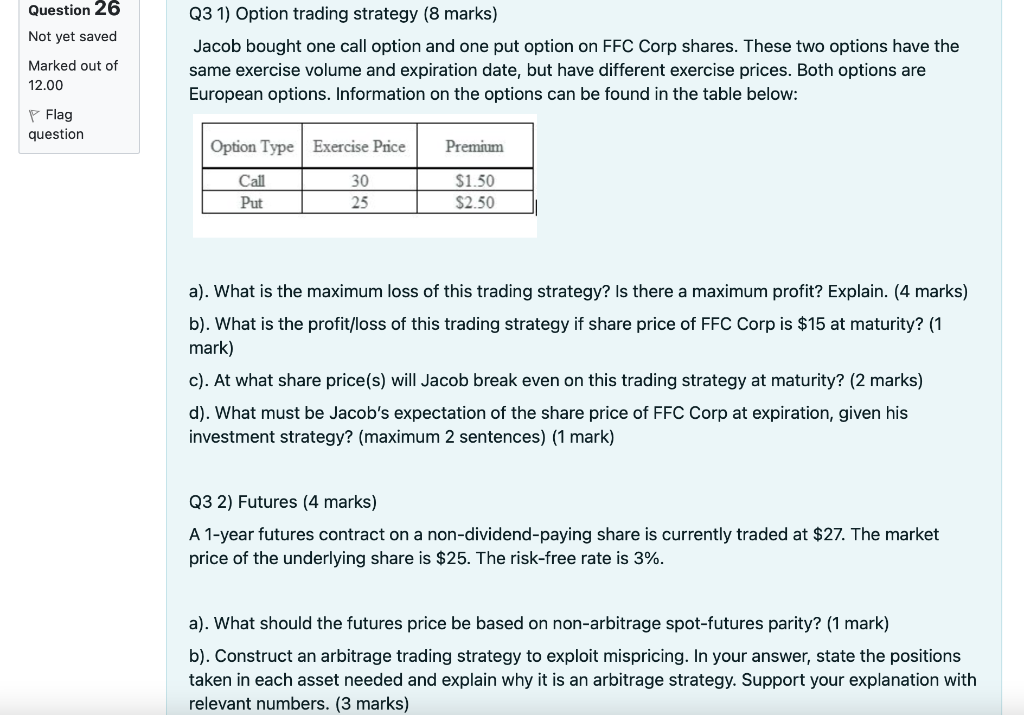

Question 25 Not yet saved The table below contains information on two shares: X and Y. Ro is the realized one-year holding period period in the year just ended. E(R1) is the forecast return for the next year based on the performance of the company. The market risk premium is 8% and risk free rate is 2%. Marked out of 10.00 Flag question Shares RO 12% 8% E(R) 10% 12% Beta 1. 2 0.8 Standard Deviation 19% 22% Y a) For a new investor who only wants to invest in one of these two shares, which share should be picked? Explain. (2 marks) b) For an investor who has already been holding a well-diversified portfolio and only wants to add more shares if doing so will improve the portfolio's alpha. Should this investor invest in X or Y? Or both? Or neither? Explain. (2 marks) c) An investor has constructed a risky portfolio Z by combing X and Y. Portfolio Z has an expected return of 11.6% and a standard deviation of 18%. If the investor wants to further combine portfolio Z with the risk-free asset to maximize expected return while having a standard deviation not higher than 15%, what should be the weights of X, Y and the risk free asset? (use E(R1) in the table as the forecast expected return for share X and Y to determine their weights in Z) (4 marks) d) If CAPM holds, how are investors expected to trade shares X and Y based on the values you have calculated in part b)? What will happen to the price of X and Y if there is no new information to be revealed to market? Explain. (2 marks) Question 26 Not yet saved Q31) Option trading strategy (8 marks) Jacob bought one call option and one put option on FFC Corp shares. These two options have the same exercise volume and expiration date, but have different exercise prices. Both options are European options. Information on the options can be found in the table below: Marked out of 12.00 Flag question Option Type Exercise Price Premium Call Put 30 25 $1.50 $2.50 a). What is the maximum loss of this trading strategy? Is there a maximum profit? Explain. (4 marks) b). What is the profit/loss of this trading strategy if share price of FFC Corp is $15 at maturity? (1 mark) c). At what share price(s) will Jacob break even on this trading strategy at maturity? (2 marks) d). What must be Jacob's expectation of the share price of FFC Corp at expiration, given his investment strategy? (maximum 2 sentences) (1 mark) Q3 2) Futures (4 marks) A 1-year futures contract on a non-dividend-paying share is currently traded at $27. The market price of the underlying share is $25. The risk-free rate is 3%. a). What should the futures price be based on non-arbitrage spot-futures parity? (1 mark) b). Construct an arbitrage trading strategy to exploit mispricing. In your answer, state the positions taken in each asset needed and explain why it is an arbitrage strategy. Support your explanation with relevant numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts