Question: Question 25 The table below contains information on two shares: X and Y. R 0 is the realized one-year holding period period in the year

Question 25

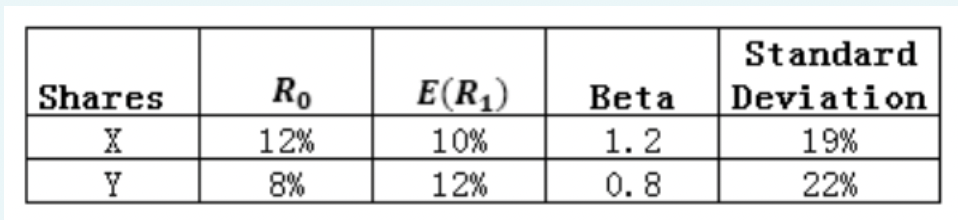

The table below contains information on two shares: X and Y. R0 is the realized one-year holding period period in the year just ended. E(R1) is the forecast return for the next year based on the performance of the company. The market risk premium is 8% and risk free rate is 2%.

d) If CAPM holds, how are investors expected to trade shares X and Y based on the values you have calculated in part b)? What will happen to the price of X and Y if there is no new information to be revealed to market? Explain. (2 marks)

Shares RO 12% 8% E(R) 10% 12% Beta 1.2 0.8 Standard Deviation 19% 22% Y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock