Question: QUESTION 25 Your all equity firm will operate for one year and then shut down operations. The firm will have one cash flow that next

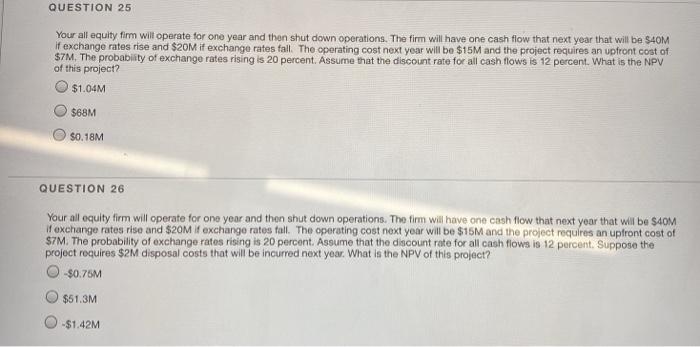

QUESTION 25 Your all equity firm will operate for one year and then shut down operations. The firm will have one cash flow that next year that will be $40M if exchange rates rise and $20M if exchange rates fall. The operating cost next year will be $15M and the project requires an upfront cost of $7M. The probability of exchange rates rising is 20 percent. Assume that the discount rate for all cash flows is 12 percent. What is the NPV of this project $1.04M $68M SO.18M QUESTION 26 Your all equity firm will operate for one year and then shut down operations. The firm will have one cash flow that next year that will be SOM fexchange rates rise and $20M f exchange rates fall. The operating cost next year will be $15M and the project requires an upfront cost of $7M. The probability of exchange rates rising is 20 percent. Assume that the discount rate for all cash flows is 12 percent. Suppose the project requires $2M disposal costs that will be incurred next year. What is the NPV of this project? $0.75M $51.3M -$1.42M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts