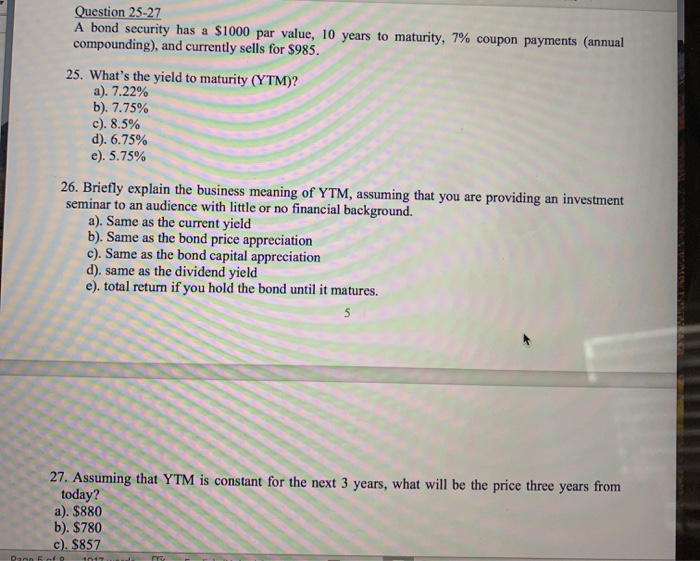

Question: Question 25-27 A bond security has a $1000 par value, 10 years to maturity, 7% coupon payments (annual compounding), and currently sells for $985. 25.

Question 25-27 A bond security has a $1000 par value, 10 years to maturity, 7% coupon payments (annual compounding), and currently sells for $985. 25. What's the yield to maturity (YTM)? a). 7.22% b). 7.75% c). 8.5% d). 6.75% e). 5.75% 26. Briefly explain the business meaning of YTM, assuming that you are providing an investment seminar to an audience with little or no financial background. a). Same as the current yield b). Same as the bond price appreciation c). Same as the bond capital appreciation d). same as the dividend yield e). total return if you hold the bond until it matures. 27. Assuming that YTM is constant for the next 3 years, what will be the price three years from today? a). $880 b). $780 c). $857 Dann 59 1017 m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts