Question: Question 26 (2 points) During 2017, a state has the following cash collections related to state Payroll withholdings and estimated payments related to 2017 income$360

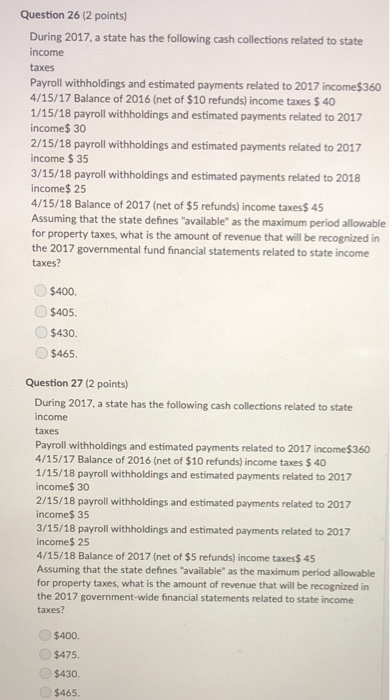

Question 26 (2 points) During 2017, a state has the following cash collections related to state Payroll withholdings and estimated payments related to 2017 income$360 4/15/17 Balance of 2016 (net of $10 refunds) income taxes $ 40 1/15/18 payroll withholdings and estimated payments related to 2017 income$ 30 2/15/18 payroll withholdings and estimated payments related to 2017 income $ 35 3/15/18 payroll withholdings and estimated payments related to 2018 ncome$ 25 4/15/18 Balance of 2017 (net of $5 refunds) income taxes$ 45 Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 governmental fund financial statements related to state income taxes? $405. $465. Question 27 (2 points) During 2017, a state has the following cash collections related to state income Payroll withholdings and estimated payments related to 2017 income$360 4/15/17 Balance of 2016 (net of $10 refunds) income taxes $ 40 1/15/18 payroll withholdings and estimated payments related to 2017 income 30 2/15/18 payroll withholdings and estimated payments related to 2017 income$ 35 3/15/18 payroll withholdings and estimated payments related to 2017 income$ 25 4/15/18 Balance of 2017 (net of $5 refunds) income taxes$ 45 Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes? $400. $475 $465

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts