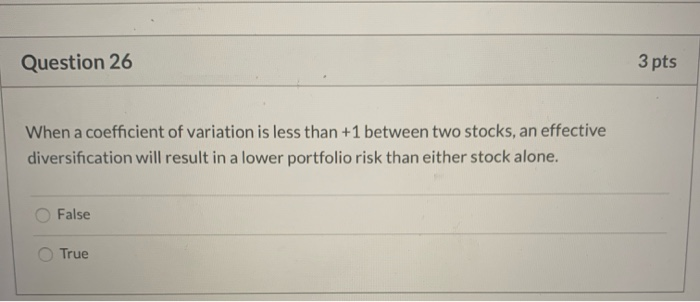

Question: Question 26 3 pts When a coefficient of variation is less than +1 between two stocks, an effective diversification will result in a lower portfolio

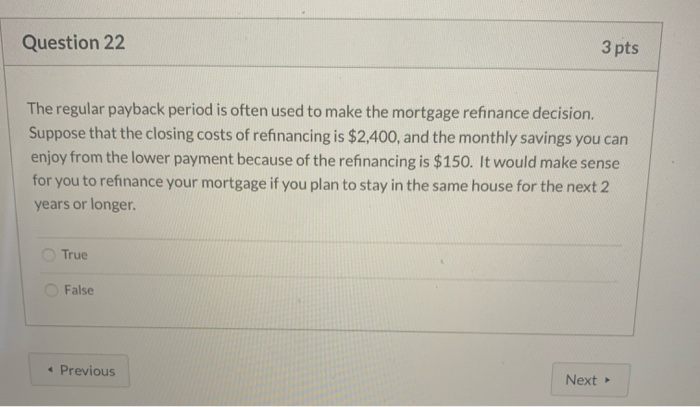

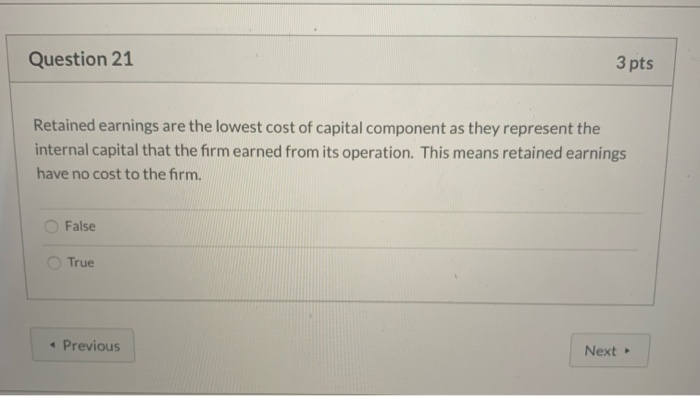

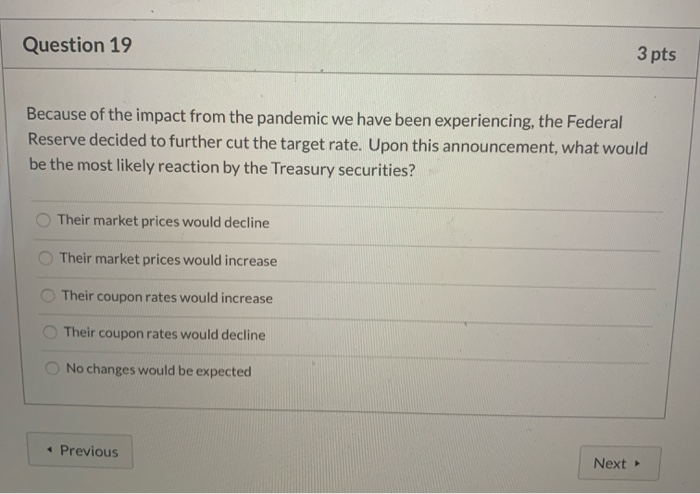

Question 26 3 pts When a coefficient of variation is less than +1 between two stocks, an effective diversification will result in a lower portfolio risk than either stock alone. False True Question 22 3 pts The regular payback period is often used to make the mortgage refinance decision. Suppose that the closing costs of refinancing is $2,400, and the monthly savings you can enjoy from the lower payment because of the refinancing is $150. It would make sense for you to refinance your mortgage if you plan to stay in the same house for the next 2 years or longer True False Previous Next Question 21 3 pts Retained earnings are the lowest cost of capital component as they represent the internal capital that the firm earned from its operation. This means retained earnings have no cost to the firm. False True - Previous Next > Question 19 3 pts Because of the impact from the pandemic we have been experiencing, the Federal Reserve decided to further cut the target rate. Upon this announcement, what would be the most likely reaction by the Treasury securities? Their market prices would decline Their market prices would increase Their coupon rates would increase Their coupon rates would decline No changes would be expected Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts