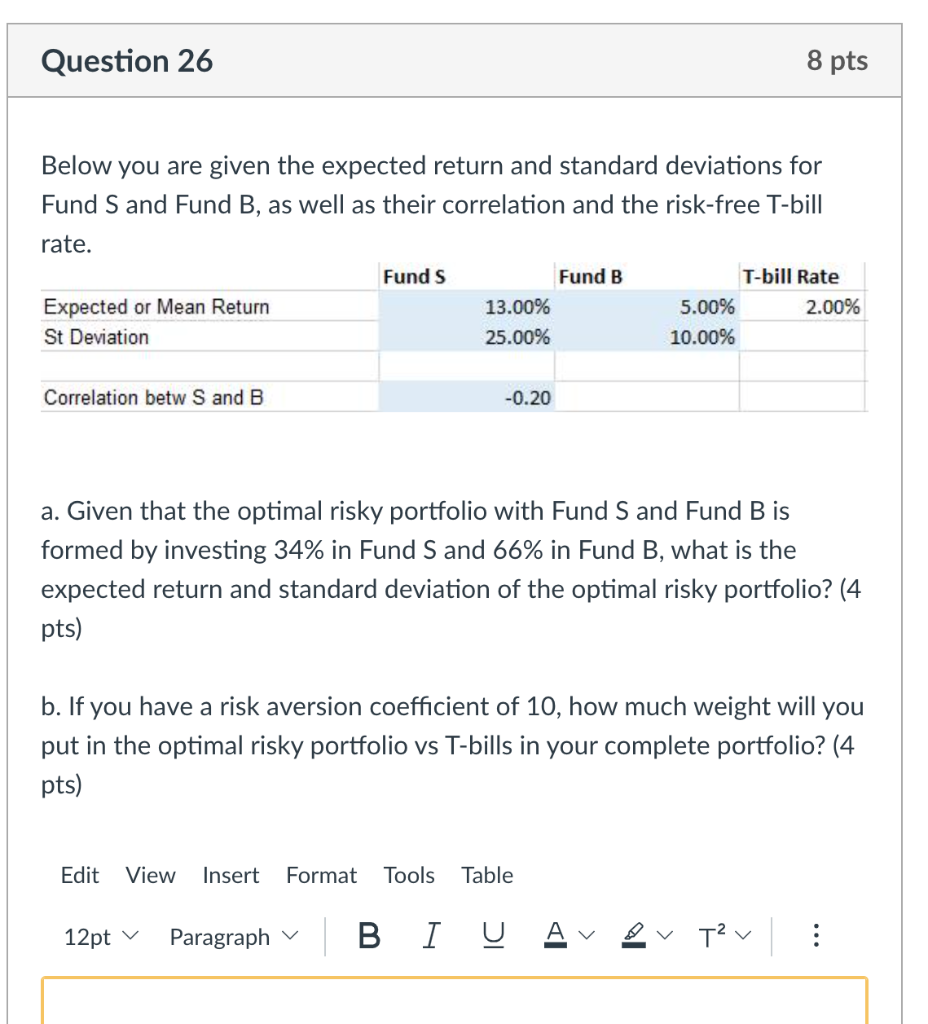

Question: Question 26 8 pts Below you are given the expected return and standard deviations for Fund S and Fund B, as well as their correlation

Question 26 8 pts Below you are given the expected return and standard deviations for Fund S and Fund B, as well as their correlation and the risk-free T-bill rate. Funds Fund B T-bill Rate Expected or Mean Return 13.00% 5.00% 2.00% St Deviation 25.00% 10.00% Correlation betw S and B -0.20 a. Given that the optimal risky portfolio with Fund S and Fund B is formed by investing 34% in Fund S and 66% in Fund B, what is the expected return and standard deviation of the optimal risky portfolio? (4 pts) b. If you have a risk aversion coefficient of 10, how much weight will you put in the optimal risky portfolio vs T-bills in your complete portfolio? (4 pts) Edit View Insert Format Tools Table 12pt v Paragraph B I Tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts