Question: QUESTION 26 Consider a corporate bond with a par value of $100, 11 years until maturity, an 8% coupon, and is callable in 7 years

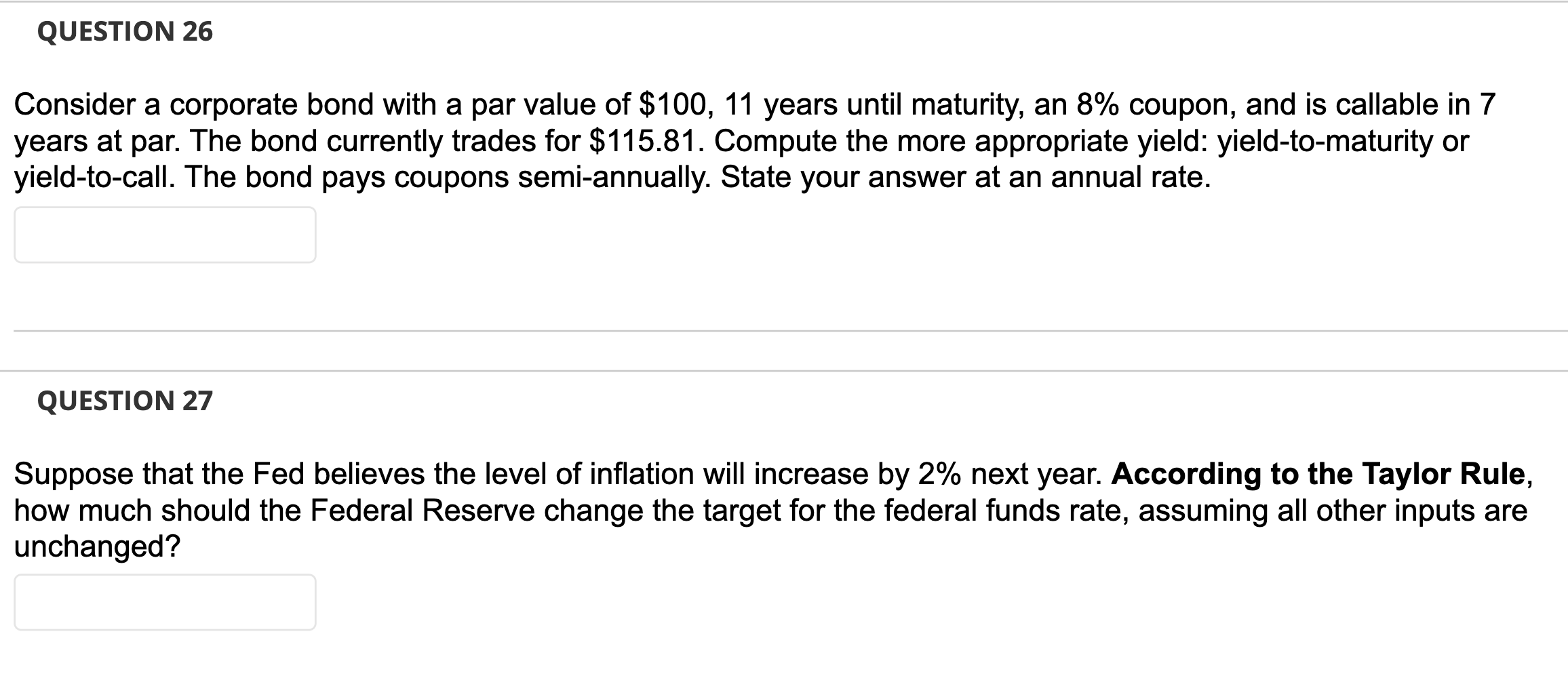

QUESTION 26 Consider a corporate bond with a par value of $100, 11 years until maturity, an 8% coupon, and is callable in 7 years at par. The bond currently trades for $115.81. Compute the more appropriate yield: yield-to-maturity or yield-to-call. The bond pays coupons semi-annually. State your answer at an annual rate. QUESTION 27 Suppose that the Fed believes the level of inflation will increase by 2% next year. According to the Taylor Rule, how much should the Federal Reserve change the target for the federal funds rate, assuming all other inputs are unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts