Question: QUESTION 26 The Hutters filed a joint return for 2018. They provide more than 50% of the support of Carla, Melvin, and Aaron. Carla (age

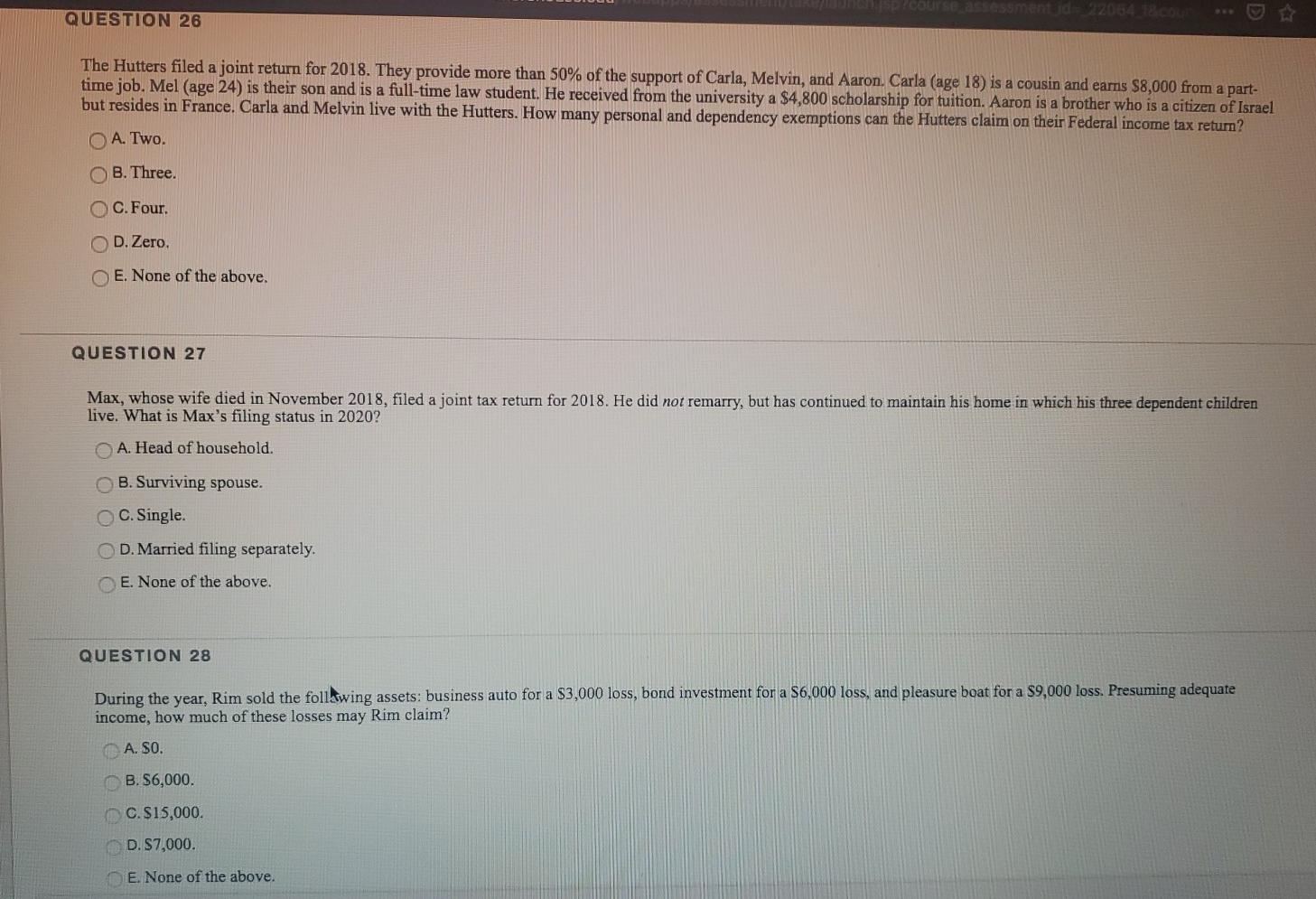

QUESTION 26 The Hutters filed a joint return for 2018. They provide more than 50% of the support of Carla, Melvin, and Aaron. Carla (age 18) is a cousin and earns $8,000 from a part- time job. Mel (age 24) is their son and is a full-time law student. He received from the university a $4,800 scholarship for tuition. Aaron is a brother who is a citizen of Israel but resides in France. Carla and Melvin live with the Hutters. How many personal and dependency exemptions can the Hutters claim on their Federal income tax return? A.Two. OB. Three. C. Four. OD. Zero. E. None of the above. QUESTION 27 Max, whose wife died in November 2018, filed a joint tax return for 2018. He did not remarry, but has continued to maintain his home in which his three dependent children live. What is Max's filing status in 2020? A. Head of household. B. Surviving spouse. C. Single. D. Married filing separately. E. None of the above. QUESTION 28 During the year, Rim sold the folllwing assets: business auto for a $3,000 loss, bond investment for a $6,000 loss, and pleasure boat for a $9,000 loss. Presuming adequate income, how much of these losses may Rim claim? A. SO. B. $6,000. C. $15,000. D. $7,000. E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts