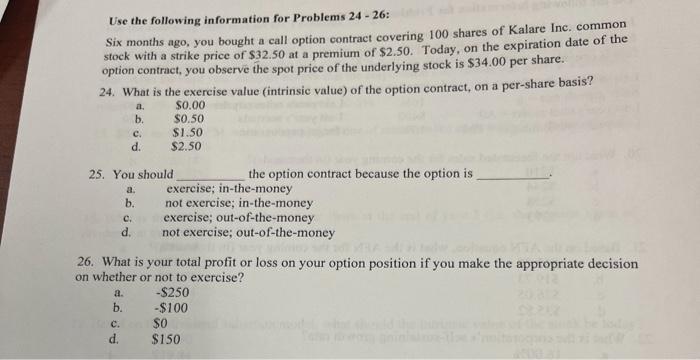

Question: Question 26 Use the following information for Problems 2426 : Six months ago, you bought a call option contract covering 100 shares of Kalare Inc.

Use the following information for Problems 2426 : Six months ago, you bought a call option contract covering 100 shares of Kalare Inc. common stock with a strike price of $32.50 at a premium of $2.50. Today, on the expiration date of the option contract, you observe the spot price of the underlying stock is $34.00 per share. 24. What is the exercise value (intrinsic value) of the option contract, on a per-share basis? a. $0.00 b. $0.50 c. $1.50 25. You should the option contract because the option is a. exercise; in-the-money b. not exercise; in-the-money c. exercise; out-of-the-money d. not exercise; out-of-the-money 26. What is your total profit or loss on your option position if you make the appropriate decision on whether or not to exercise? a. $250 b. $100 c. $0 d. $150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts