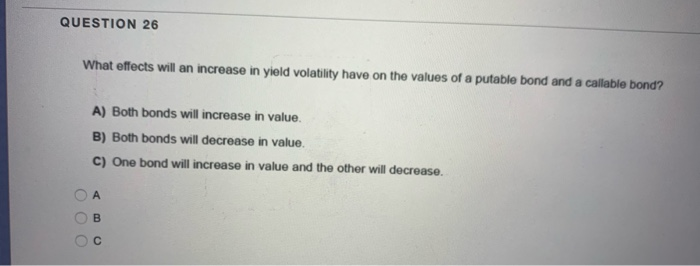

Question: QUESTION 26 What effects will an increase in yield volatility have on the values of a putable bond and a callable bond? A) Both bonds

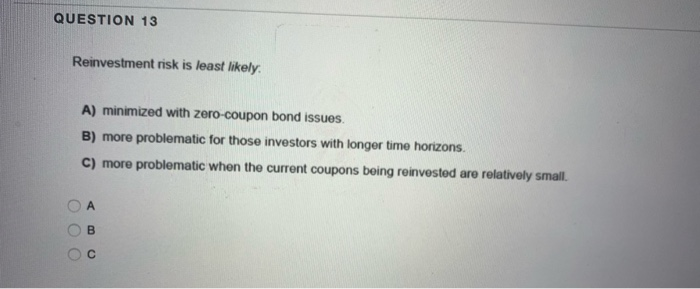

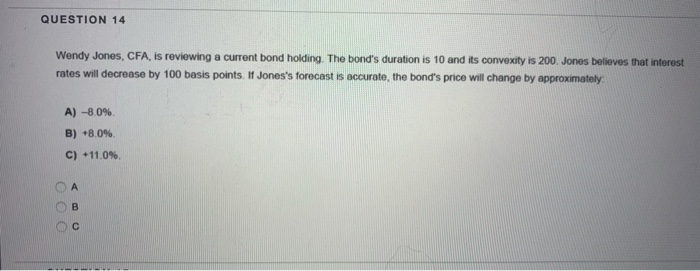

QUESTION 26 What effects will an increase in yield volatility have on the values of a putable bond and a callable bond? A) Both bonds will increase in value. B) Both bonds will decrease in value. C) One bond will increase in value and the other will decrease. O A QUESTION 13 Reinvestment risk is least likely A) minimized with zero-coupon bond issues, B) more problematic for those investors with longer time horizons C) more problematic when the current coupons being reinvested are relatively small. OA QUESTION 14 Wendy Jones, CFA, is reviewing a current bond holding. The bond's duration is 10 and its convexity is 200. Jones believes that interest rates will decrease by 100 basis points. If Jones's forecast is accurate, the bond's price will change by approximately A) -8.0% B) +8.0% C) 11.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts