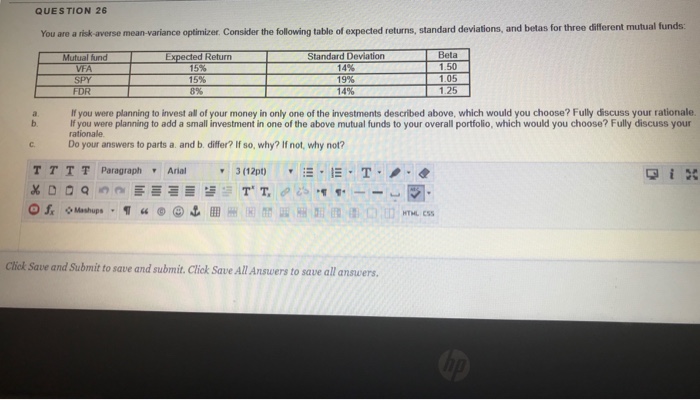

Question: QUESTION 26 You are a risk averse mean-variance optimizer. Consider the following table of expected returns, standard deviations, and betas for three different mutual funds:

QUESTION 26 You are a risk averse mean-variance optimizer. Consider the following table of expected returns, standard deviations, and betas for three different mutual funds: Standard Deviation 14% 19% 14% Beta 1.50 1.05 1.25 VFA SPY FDR 15% 15% a If you were planning to invest all of your money in only one of the investments described above, which would you choose? Fully discuss your rationale. b If you were planning to add a small investment in one of the above mutual funds to your overall portfolio, which would you choose? Fully discuss your rationale Do your answers to parts a. and b. differ? If so, why? If not, why not? c. TT T Paragraph Arial 3 (12pt)E E T HTHL ESS Chok Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts