Question: Question 26(7 points) stred a) Allied Contracting Inc. is considering the purchase of a new dump truck for $75,000. If the vehicle can be depreciated

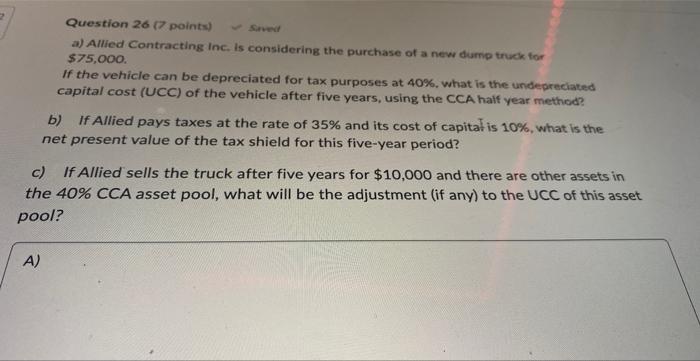

Question 26(7 points) stred a) Allied Contracting Inc. is considering the purchase of a new dump truck for $75,000. If the vehicle can be depreciated for tax purposes at 40%, what is the undepreciated capital cost (UCC) of the vehicle after five years, using the CCA half year method? b) If Allied pays taxes at the rate of 35% and its cost of capitat is 10%, what is the net present value of the tax shield for this five-year period? c) If Allied sells the truck after five years for $10,000 and there are other assets in he 40% CCA asset pool, what will be the adjustment (if any) to the UCC of this asset ool

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock