Question: Question 27 (2 points) Matthew opens a small jewelry store in New York City that only sells one type of jewelry. The major cost of

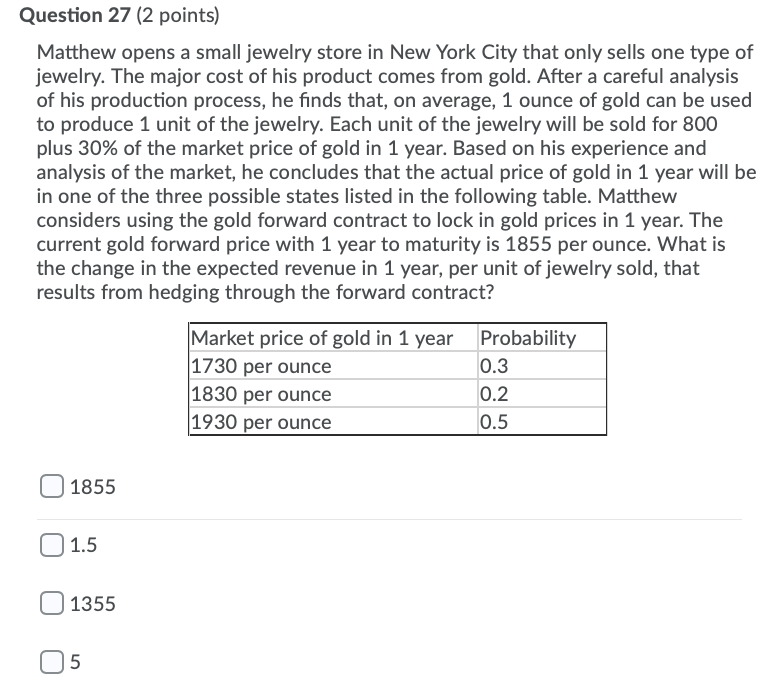

Question 27 (2 points) Matthew opens a small jewelry store in New York City that only sells one type of jewelry. The major cost of his product comes from gold. After a careful analysis of his production process, he finds that, on average, 1 ounce of gold can be used to produce 1 unit of the jewelry. Each unit of the jewelry will be sold for 800 plus 30% of the market price of gold in 1 year. Based on his experience and analysis of the market, he concludes that the actual price of gold in 1 year will be in one of the three possible states listed in the following table. Matthew considers using the gold forward contract to lock in gold prices in 1 year. The current gold forward price with 1 year to maturity is 1855 per ounce. What is the change in the expected revenue in 1 year, per unit of jewelry sold, that results from hedging through the forward contract? Market price of gold in 1 year Probability 1730 per ounce 0.3 1830 per ounce 0.2 1930 per ounce 0.5 1855 1.5 1355 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts