Question: Question 27 ( 8 points) David opened an IT Services Business on January 1,2015 , by investing $40,000 of his own money. After several years

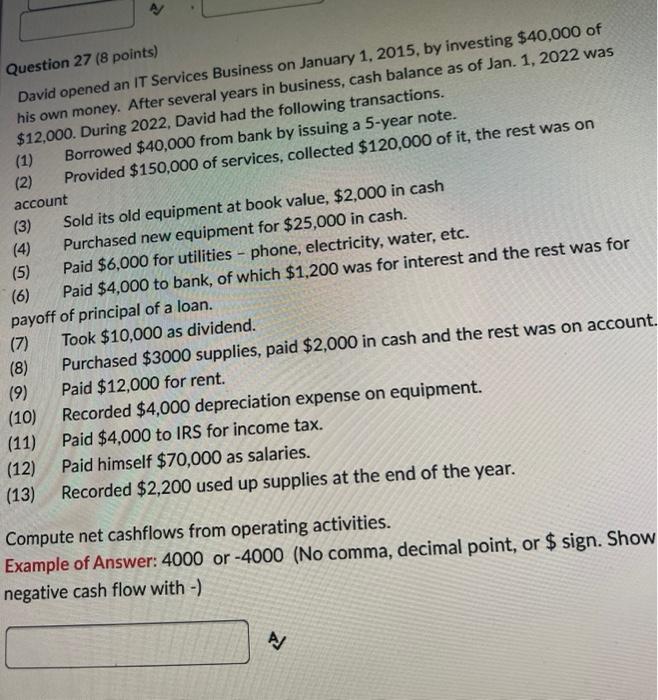

Question 27 ( 8 points) David opened an IT Services Business on January 1,2015 , by investing $40,000 of his own money. After several years in business, cash balance as of Jan. 1, 2022 was $12,000. During 2022, David had the following transactions. (1) Borrowed $40,000 from bank by issuing a 5 -year note. (2) Provided $150,000 of services, collected $120,000 of it, the rest was on account (3) Sold its old equipment at book value, $2,000 in cash (4) Purchased new equipment for $25,000 in cash. (5) Paid $6,000 for utilities - phone, electricity, water, etc. (6) Paid $4,000 to bank, of which $1,200 was for interest and the rest was for payoff of principal of a loan. (7) Took $10,000 as dividend. (8) Purchased $3000 supplies, paid $2,000 in cash and the rest was on account (9) Paid $12,000 for rent. (10) Recorded $4,000 depreciation expense on equipment. (11) Paid $4,000 to IRS for income tax. (12) Paid himself $70,000 as salaries. (13) Recorded $2,200 used up supplies at the end of the year. Compute net cashflows from operating activities. Example of Answer: 4000 or -4000 (No comma, decimal point, or $ sign. Show negative cash flow with -)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts