Question: QUESTION 27 Barnard 4 Corp is considering a new project. Details: Project will require $400,000 for new foxed assets. Project requires $250,000 of additional networking

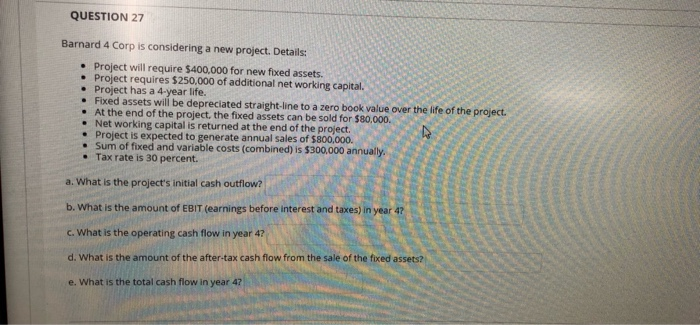

QUESTION 27 Barnard 4 Corp is considering a new project. Details: Project will require $400,000 for new foxed assets. Project requires $250,000 of additional networking capital. Project has a 4-year life. Fixed assets will be depreciated straight line to a zero book value over the life of the project. . At the end of the project, the fixed assets can be sold for $80,000. Net working capital is returned at the end of the project. Project is expected to generate annual sales of $800,000. Sum of fixed and variable costs (combined) is $300,000 annually. Tax rate is 30 percent. a. What is the project's initial cash outflow? b. What is the amount of EBIT (earnings before interest and taxes) inye c. What is the operating cash flow in year 47 d. What is the amount of the after-tax cash flow from the sale of e. What is the total cash flow in year 47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts