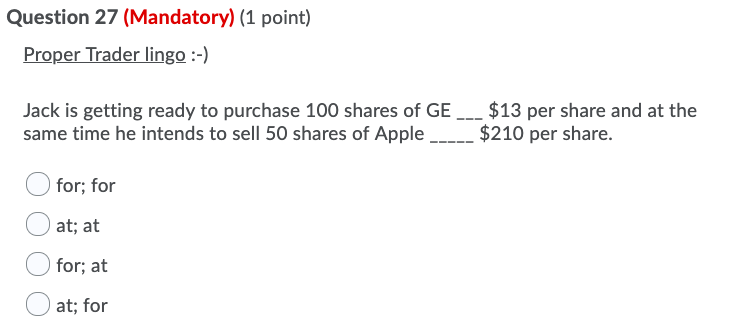

Question: Question 27 (Mandatory) (1 point) Proper Trader lingo :-) $13 per share and at the $210 per share. Jack is getting ready to purchase 100

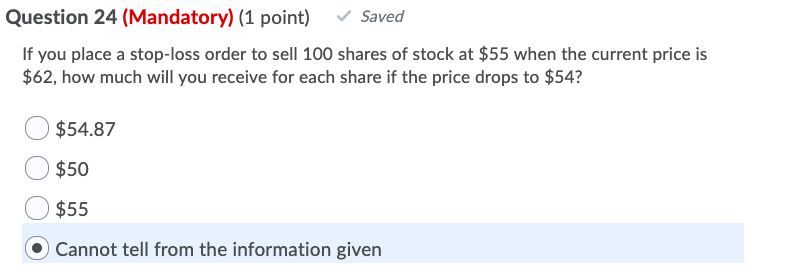

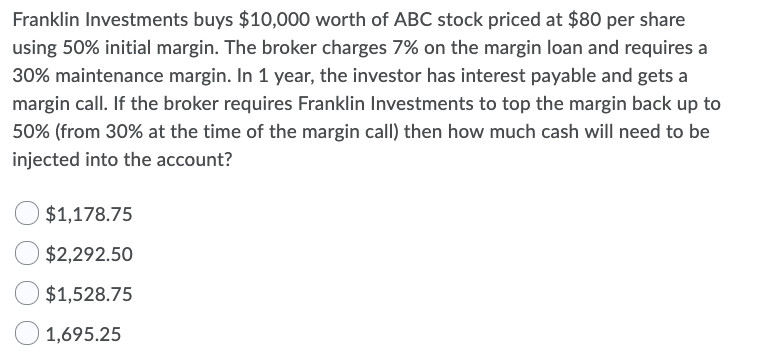

Question 27 (Mandatory) (1 point) Proper Trader lingo :-) $13 per share and at the $210 per share. Jack is getting ready to purchase 100 shares of GE same time he intends to sell 50 shares of Apple for; for at; at for; at at; for Question 24 (Mandatory) (1 point) Saved If you place a stop-loss order to sell 100 shares of stock at $55 when the current price is $62, how much will you receive for each share if the price drops to $54? $54.87 $50 $55 Cannot tell from the information given Franklin Investments buys $10,000 worth of ABC stock priced at $80 per share using 50% initial margin. The broker charges 7% on the margin loan and requires a 30% maintenance margin. In 1 year, the investor has interest payable and gets a margin call. If the broker requires Franklin Investments to top the margin back up to 50% (from 30% at the time of the margin call) then how much cash will need to be injected into the account? $1,178.75 $2,292.50 $1,528.75 O 1,695.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts