Question: Question 27 (Mandatory) (1 point) When the correlation coefficient between the returns of two securities is zero, an investor can still receive benefits from diversifying

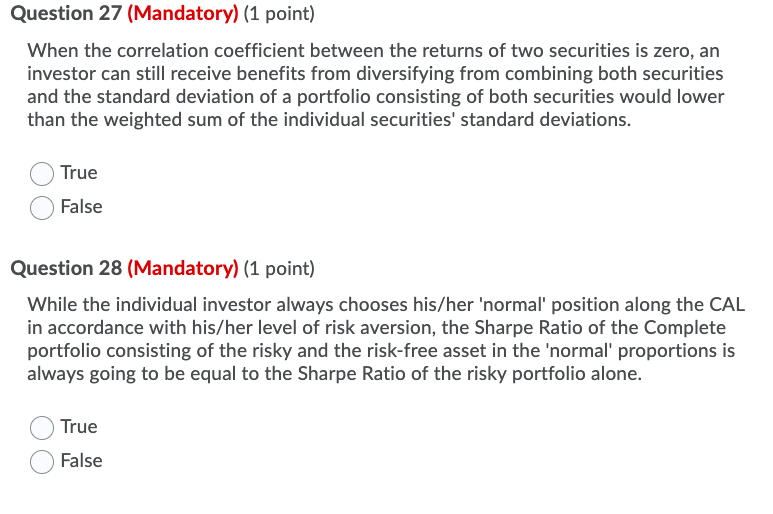

Question 27 (Mandatory) (1 point) When the correlation coefficient between the returns of two securities is zero, an investor can still receive benefits from diversifying from combining both securities and the standard deviation of a portfolio consisting of both securities would lower than the weighted sum of the individual securities' standard deviations. True False Question 28 (Mandatory) (1 point) While the individual investor always chooses his/her 'normal' position along the CAL in accordance with his/her level of risk aversion, the Sharpe Ratio of the Complete portfolio consisting of the risky and the risk-free asset in the 'normal' proportions is always going to be equal to the Sharpe Ratio of the risky portfolio alone. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts