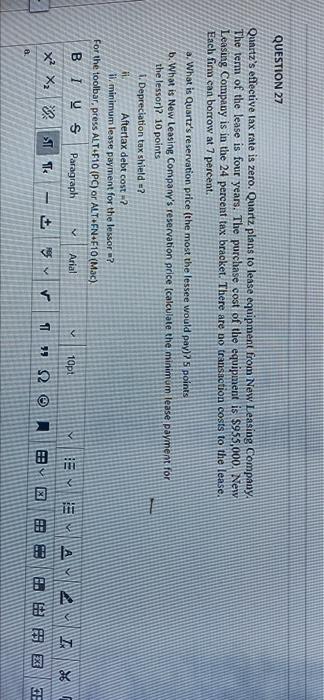

Question: QUESTION 27 Quartz's effective tax rate is zero. Quartz plans to lease equipment from New Leasing Company The term of the lease is four years.

QUESTION 27 Quartz's effective tax rate is zero. Quartz plans to lease equipment from New Leasing Company The term of the lease is four years. The purchase cost of the equipment is $955.000. New Leasing Company is in the 24 percent tax bracket. There are no transaction costs to the lease. Each firm can borrow at 7 percent. a. What is Quartz's reservation price (the most the lessee would pay)? 5 points b. What is New Leasing Company's reservation price calculate the minimum lease payment for the lessor)? 10 points 1. Depreciation tox shield ? . Aftertax debt cost? il/minimum lease payment for the lessor ? For the toolbar, press ALT F10 (PC) or ALT EN F10 (Mac). BIVS Paragraph Arial 10pt PE V X X TTT 11 * S2 X !! e. BAX A QUESTION 27 Quartz's effective tax rate is zero. Quartz plans to lease equipment from New Leasing Company The term of the lease is four years. The purchase cost of the equipment is $955.000. New Leasing Company is in the 24 percent tax bracket. There are no transaction costs to the lease. Each firm can borrow at 7 percent. a. What is Quartz's reservation price (the most the lessee would pay)? 5 points b. What is New Leasing Company's reservation price calculate the minimum lease payment for the lessor)? 10 points 1. Depreciation tox shield ? . Aftertax debt cost? il/minimum lease payment for the lessor ? For the toolbar, press ALT F10 (PC) or ALT EN F10 (Mac). BIVS Paragraph Arial 10pt PE V X X TTT 11 * S2 X !! e. BAX A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts