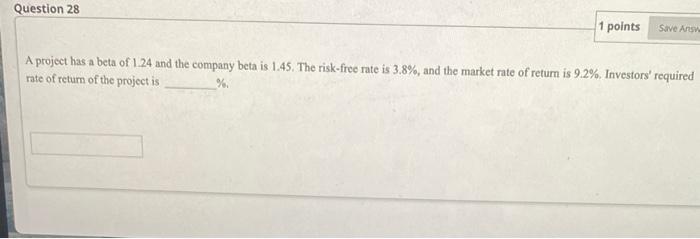

Question: Question 28 1 points Save As A project has a beta of 124 and the company beta is 1.45. The risk-free rate is 3.8%, and

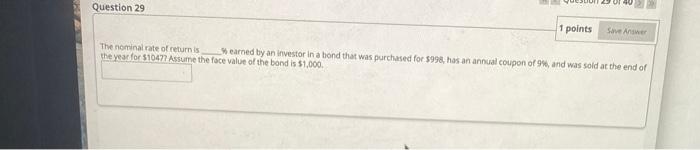

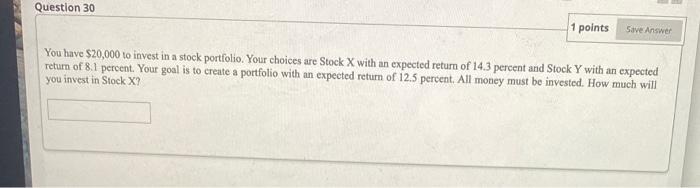

Question 28 1 points Save As A project has a beta of 124 and the company beta is 1.45. The risk-free rate is 3.8%, and the market rate of return is 9.2%. Investors' required rate of retum of the project is Question 29 1 points Save A The nominal rate of returns earned by an investor in a bond that was purchased for $998, has an annual coupon of 94, and was sold at the end of the year for $1047 Assume the face value of the bond is $1.000 Question 30 1 points Save Answer You have $20,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14.3 percent and Stock Y with an expected return of 8.1 percent. Your goal is to create a portfolio with an expected return of 12.5 percent. All money must be invested. How much will you invest in Stock X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts