Question: Question 28 (15 points) Prepare the required adjusting journal entry for each situation as of December 31 Year 1. After making the adjusting journal entries,

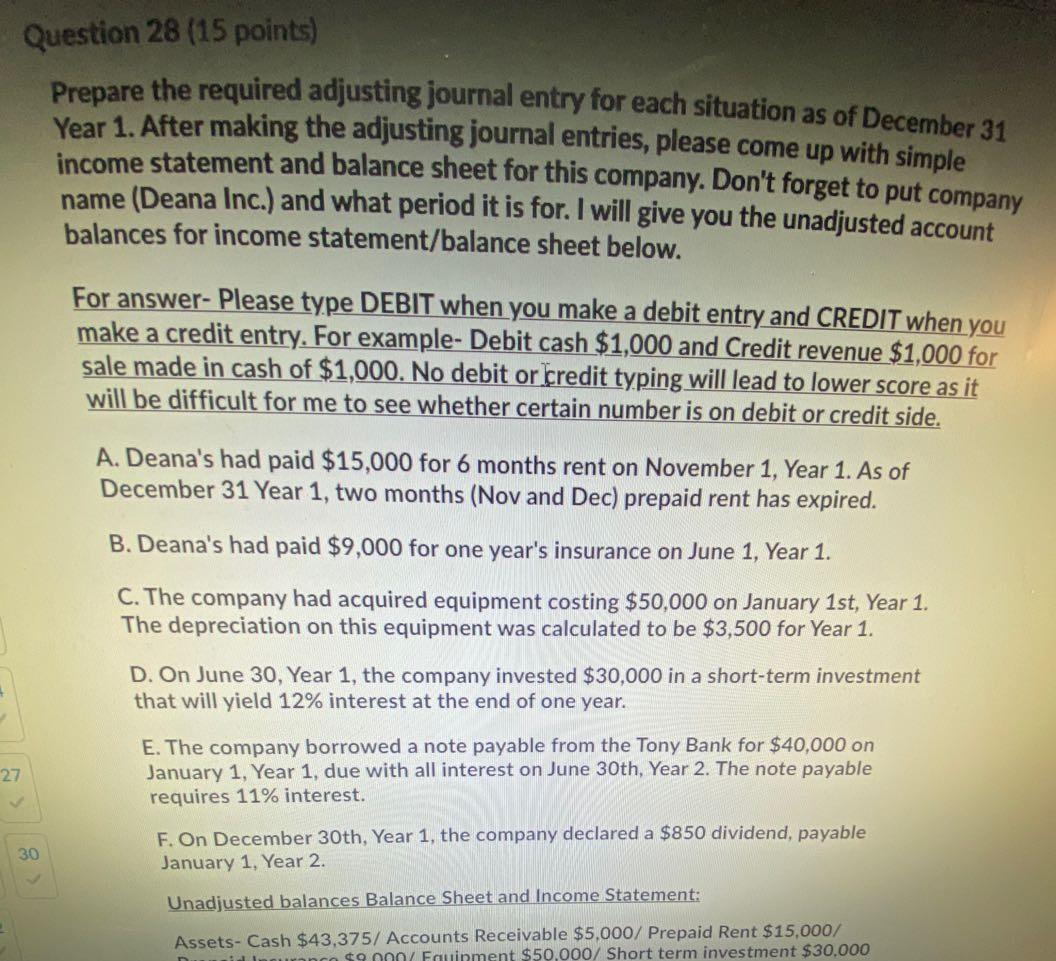

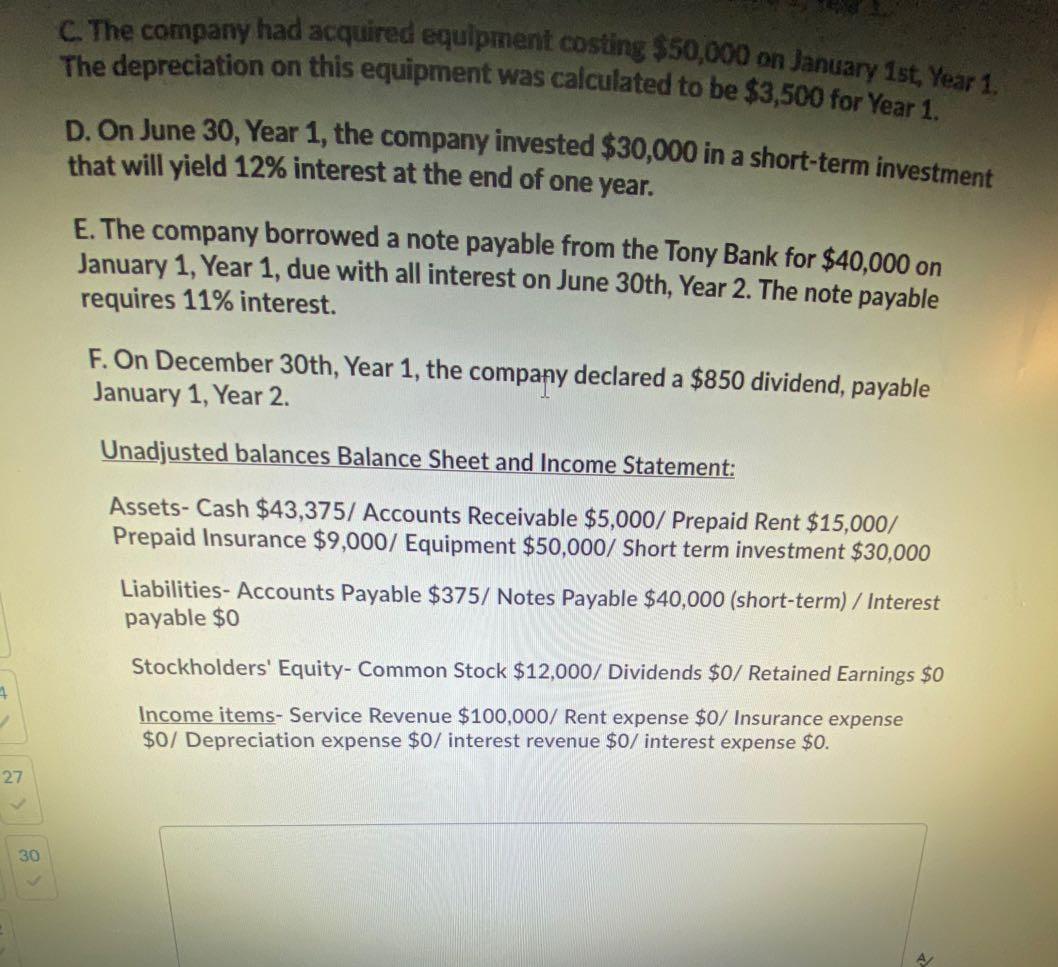

Question 28 (15 points) Prepare the required adjusting journal entry for each situation as of December 31 Year 1. After making the adjusting journal entries, please come up with simple income statement and balance sheet for this company. Don't forget to put company name (Deana Inc.) and what period it is for. I will give you the unadjusted account balances for income statement/balance sheet below. For answer. Please type DEBIT when you make a debit entry and CREDIT when you make a credit entry. For example- Debit cash $1,000 and Credit revenue $1,000 for sale made in cash of $1,000. No debit or credit typing will lead to lower score as it will be difficult for me to see whether certain number is on debit or credit side. A. Deana's had paid $15,000 for 6 months rent on November 1, Year 1. As of December 31 Year 1, two months (Nov and Dec) prepaid rent has expired. B. Deana's had paid $9,000 for one year's insurance on June 1, Year 1. C. The company had acquired equipment costing $50,000 on January 1st, Year 1. The depreciation on this equipment was calculated to be $3,500 for Year 1. D. On June 30, Year 1, the company invested $30,000 in a short-term investment that will yield 12% interest at the end of one year. 27 E. The company borrowed a note payable from the Tony Bank for $40,000 on January 1, Year 1, due with all interest on June 30th, Year 2. The note payable requires 11% interest. 30 F. On December 30th, Year 1, the company declared a $850 dividend, payable January 1, Year 2. Unadjusted balances Balance Sheet and Income Statement: Assets- Cash $43,375/ Accounts Receivable $5,000/ Prepaid Rent $15.000/ $9 00 Fainment $50,000/ Short term investment $30.000 C. The company had acquired equipment costing $50,000 on January 1st, Year 1. The depreciation on this equipment was calculated to be $3,500 for Year 1. D. On June 30, Year 1, the company invested $30,000 in a short-term investment that will yield 12% interest at the end of one year. E. The company borrowed a note payable from the Tony Bank for $40,000 on January 1, Year 1, due with all interest on June 30th, Year 2. The note payable requires 11% interest. F. On December 30th, Year 1, the company declared a $850 dividend, payable January 1, Year 2. Unadjusted balances Balance Sheet and Income Statement: Assets- Cash $43,375/ Accounts Receivable $5,000/ Prepaid Rent $15,000/ Prepaid Insurance $9,000/ Equipment $50,000/ Short term investment $30,000 Liabilities- Accounts Payable $375/ Notes Payable $40,000 (short-term) / Interest payable $0 Stockholders' Equity- Common Stock $12,000/ Dividends $0/ Retained Earnings $0 4 Income items- Service Revenue $100,000/ Rent expense $0/ Insurance expense $0/ Depreciation expense $0/ interest revenue $0/ interest expense $0. 27 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts