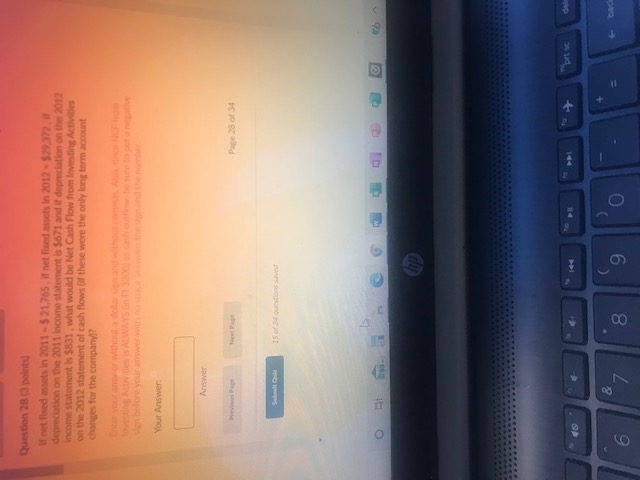

Question: Question 28 (3 points) It net fled assets in 2011 - $ 21,765, if net fixed assets in 2012-$29,372, depreciation on the 2011 income statement

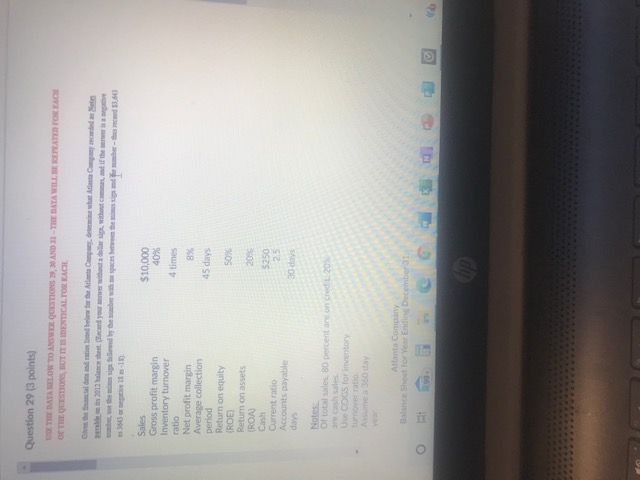

Question 28 (3 points) It net fled assets in 2011 - $ 21,765, if net fixed assets in 2012-$29,372, depreciation on the 2011 income statement is $671 and if depreciation on the 2012 Income statement is 5831, what would be Net Cash Flow from Investing Activities on the 2012 statement of cash flows (if these were the only long term account changes for the company? your without a delle donne on belore your answer with Your Answer: Answer Page 28 15 of O s! hp "prt so 6 & 7 00 9 O Question 29 (3 points) THE DATA BELOW TO ANSWER QUESTIONS 29, 30 AND 11 - THE DATA WILL BE PEATED FOR THE OF THE QUESTIONS, BUT IT IS IDENTICAL FOR EACH Che facial data isted below for the Chat At Company and More 1360 or -15) $10,000 40% 4 times 89 45 days Sales Gross profit margin Inventory turnover ratio Net profit margin Average collection period Return on equity (ROE) Return on assets (ROA Cash Current ratio Accounts payable days 50 20 $250 25 30 days Notes of total sales 80 percentar on cred 20% U COGS for inventory Asume a 360 day Altanta Company Balance Sheet for Year Ending December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts