Question: QUESTION 28 Use the information below for the next two questions The total payroll of a company for the month of October 2019 was $280,000.

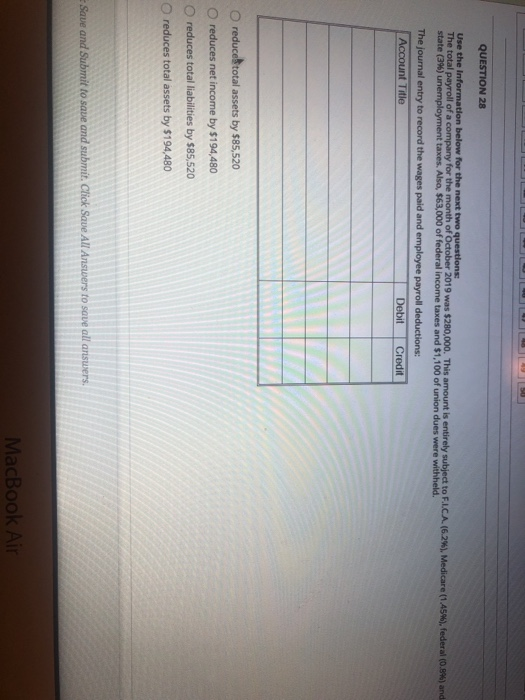

QUESTION 28 Use the information below for the next two questions The total payroll of a company for the month of October 2019 was $280,000. This amount is entirely subject to F.L.C.A. (6.2%), Medicare (1.45%), federal (0.8%) and state (34) unemployment taxes. Also, $63,000 of federal income taxes and $1,100 of union dues were withheld. The journal entry to record the wages paid and employee payroll deductions: Account Title Debit Credit reduce total assets by $85,520 reduces net income by $194,480 reduces total liabilities by $85,520 reduces total assets by $194,480 Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts