Question: Question 29 (1 point) Saved The local grain basis, as defined in this class, is O the difference between the local cash (spot) price and

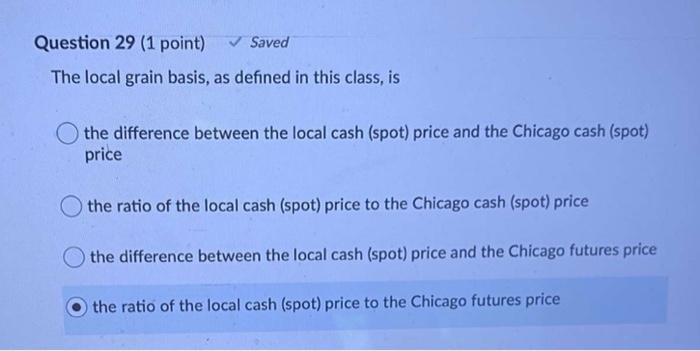

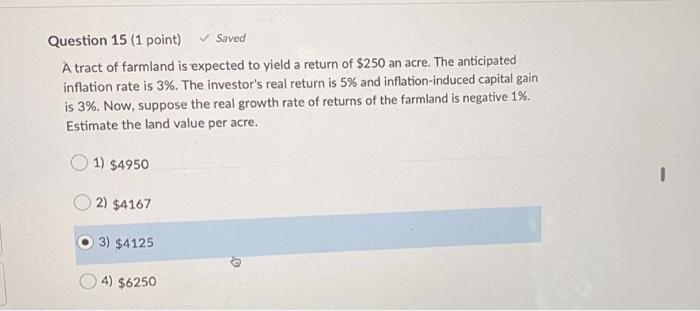

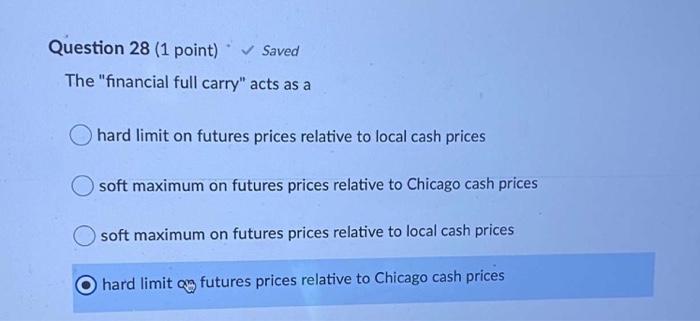

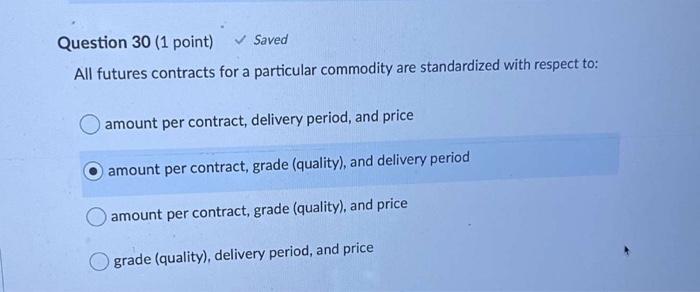

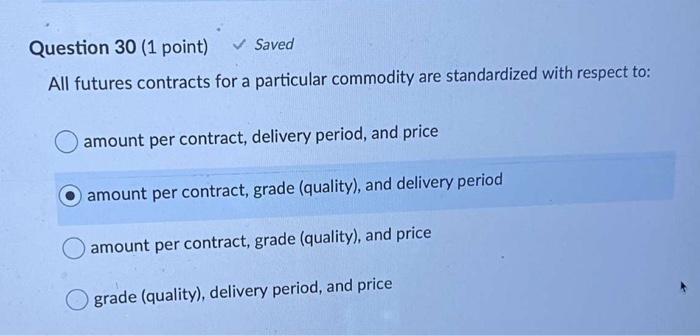

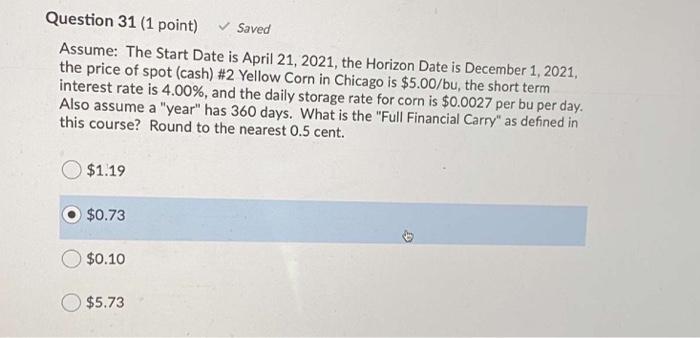

Question 29 (1 point) Saved The local grain basis, as defined in this class, is O the difference between the local cash (spot) price and the Chicago cash (spot) price the ratio of the local cash (spot) price to the Chicago cash (spot) price the difference between the local cash (spot) price and the Chicago futures price the ratio of the local cash (spot) price to the Chicago futures price Question 15 (1 point) Saved A tract of farmland is expected to yield a return of $250 an acre. The anticipated inflation rate is 3%. The investor's real return is 5% and inflation-induced capital gain is 3%. Now, suppose the real growth rate of returns of the farmland is negative 1%. Estimate the land value per acre. 1) $4950 2) $4167 3) $4125 19 4) $6250 Question 28 (1 point) Saved The "financial full carry" acts as a hard limit on futures prices relative to local cash prices soft maximum on futures prices relative to Chicago cash prices soft maximum on futures prices relative to local cash prices hard limit on futures prices relative to Chicago cash prices Question 30 (1 point) Saved All futures contracts for a particular commodity are standardized with respect to: amount per contract, delivery period, and price amount per contract, grade (quality), and delivery period amount per contract, grade (quality), and price grade (quality), delivery period, and price Question 30 (1 point) Saved All futures contracts for a particular commodity are standardized with respect to: amount per contract, delivery period, and price amount per contract, grade (quality), and delivery period amount per contract, grade (quality), and price grade (quality), delivery period, and price Question 31 (1 point) Saved Assume: The Start Date is April 21, 2021, the Horizon Date is December 1, 2021, the price of spot (cash) #2 Yellow Corn in Chicago is $5.00/bu, the short term interest rate is 4.00%, and the daily storage rate for corn is $0.0027 per bu per day. Also assume a "year" has 360 days. What is the "Full Financial Carry" as defined in this course? Round to the nearest 0.5 cent. $1.19 $0.73 $0.10 $5.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts