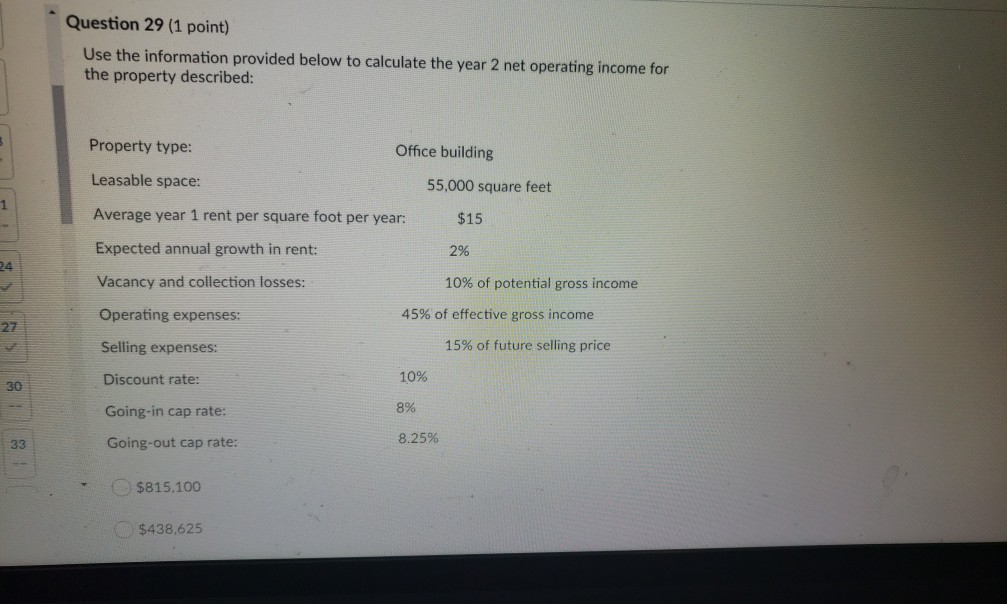

Question: Question 29 (1 point) Use the information provided below to calculate the year 2 net operating income for the property described: Property type: Office building

Question 29 (1 point) Use the information provided below to calculate the year 2 net operating income for the property described: Property type: Office building Leasable space: 55,000 square feet Average year 1 rent per square foot per year: $15 Expected annual growth in rent: 2% Vacancy and collection losses: 10% of potential gross income Operating expenses: 45% of effective gross income Selling expenses: 15% of future selling price Discount rate: 10% Going-in cap rate: 8% Going-out cap rate: 8.25% 8 $815.100 $438,625 Question 29 (1 point) Use the information provided below to calculate the year 2 net operating income for the property described: Property type: Office building Leasable space: 55,000 square feet Average year 1 rent per square foot per year: $15 Expected annual growth in rent: 2% Vacancy and collection losses: 10% of potential gross income Operating expenses: 45% of effective gross income Selling expenses: 15% of future selling price Discount rate: 10% Going-in cap rate: 8% Going-out cap rate: 8.25% 8 $815.100 $438,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts