Question: Question 29 (1 point) Your company is considering a project which will require the purchase of $635,000 in new equipment. The company expects to sell

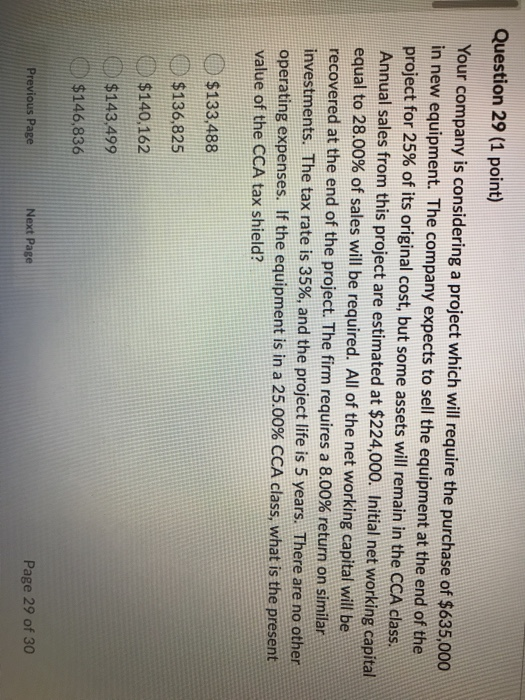

Question 29 (1 point) Your company is considering a project which will require the purchase of $635,000 in new equipment. The company expects to sell the equipment at the end of the project for 25% of its original cost, but some assets will remain in the CCA class. Annual sales from this project are estimated at $224,000. Initial net working capital equal to 28.00% of sales will be required. All of the net working capital will be recovered at the end of the project. The firm requires a 8.00% return on similar investments. The tax rate is 35%, and the project life is 5 years. There are no other operating expenses. If the equipment is in a 25.00% CCA class, what is the present value of the CCA tax shield? $ 133,488 $136,825 $140,162 $143,499 $146,836 Previous Page Next Page Page 29 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts