Question: Question 29 1 pts Which statement is most accurate given the following information: Company A: Current Ratio: 1.4; Inventory Turnover: 9.0; Days Sales Outstanding: 34.2:

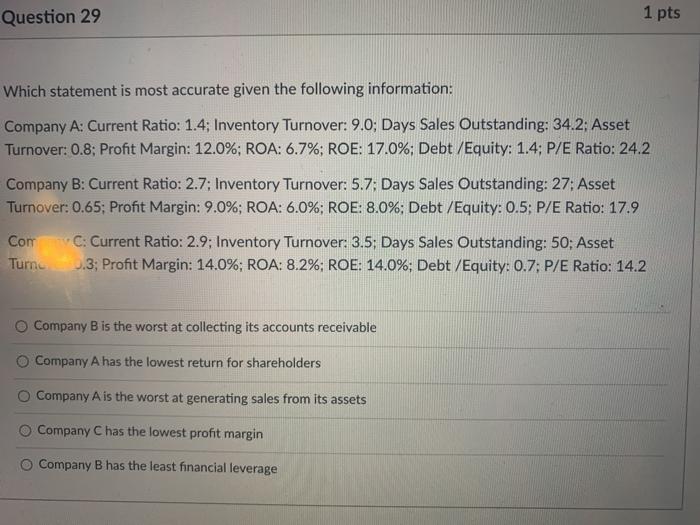

Question 29 1 pts Which statement is most accurate given the following information: Company A: Current Ratio: 1.4; Inventory Turnover: 9.0; Days Sales Outstanding: 34.2: Asset Turnover: 0.8; Profit Margin: 12.0%; ROA: 6.7%; ROE: 17.0%: Debt /Equity: 1.4; P/E Ratio: 24.2 Company B: Current Ratio: 2.7: Inventory Turnover: 5.7: Days Sales Outstanding: 27: Asset Turnover: 0.65; Profit Margin: 9.0%; ROA: 6.0%; ROE: 8.0%; Debt /Equity: 0.5; P/E Ratio: 17.9 ComC: Current Ratio: 2.9; Inventory Turnover: 3.5; Days Sales Outstanding: 50; Asset Turn 1.3: Profit Margin: 14.0%; ROA: 8.2%; ROE: 14.0%; Debt /Equity: 0.7: P/E Ratio: 14.2 Company B is the worst at collecting its accounts receivable Company A has the lowest return for shareholders O Company A is the worst at generating sales from its assets Company C has the lowest profit margin Company B has the least financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts