Question: Question 29 (2 points) Suppose that it is April 30th, and a treasurer realizes that on September 20th the company will have to issue $5

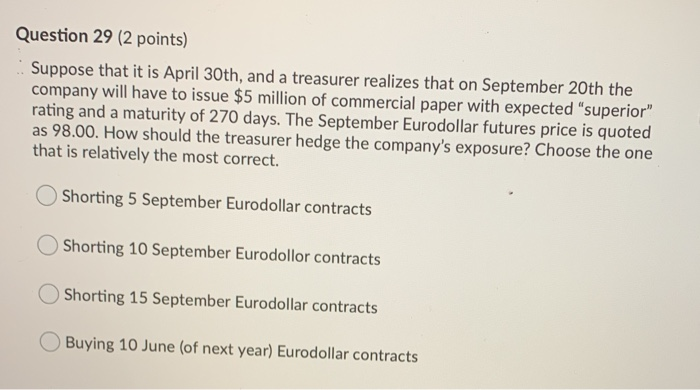

Question 29 (2 points) Suppose that it is April 30th, and a treasurer realizes that on September 20th the company will have to issue $5 million of commercial paper with expected "superior" rating and a maturity of 270 days. The September Eurodollar futures price is quoted as 98.00. How should the treasurer hedge the company's exposure? Choose the one that is relatively the most correct. Shorting 5 September Eurodollar contracts Shorting 10 September Eurodollor contracts Shorting 15 September Eurodollar contracts Buying 10 June (of next year) Eurodollar contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts