Question: Question 29 a) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.60=1.00 and the dollar-pound exchange rate

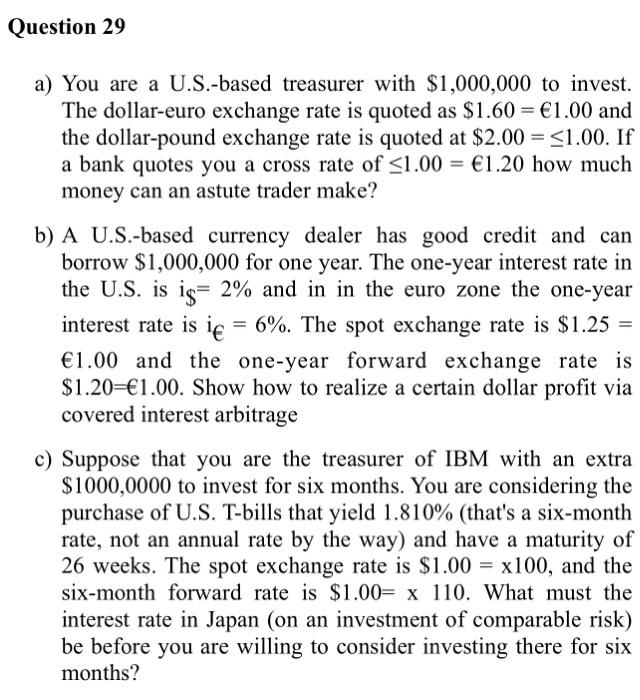

Question 29 a) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.60=1.00 and the dollar-pound exchange rate is quoted at $2.00=1.00. If a bank quotes you a cross rate of 1.00=1.20 how much money can an astute trader make? b) A U.S.-based currency dealer has good credit and can borrow $1,000,000 for one year. The one-year interest rate in the U.S. is i$=2% and in in the euro zone the one-year interest rate is i6%. The spot exchange rate is $1.25= 1.00 and the one-year forward exchange rate is $1.20=1.00. Show how to realize a certain dollar profit via covered interest arbitrage c) Suppose that you are the treasurer of IBM with an extra $1000,0000 to invest for six months. You are considering the purchase of U.S. T-bills that yield 1.810% (that's a six-month rate, not an annual rate by the way) and have a maturity of 26 weeks. The spot exchange rate is $1.00=x100, and the six-month forward rate is $1.00=x110. What must the interest rate in Japan (on an investment of comparable risk) be before you are willing to consider investing there for six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts