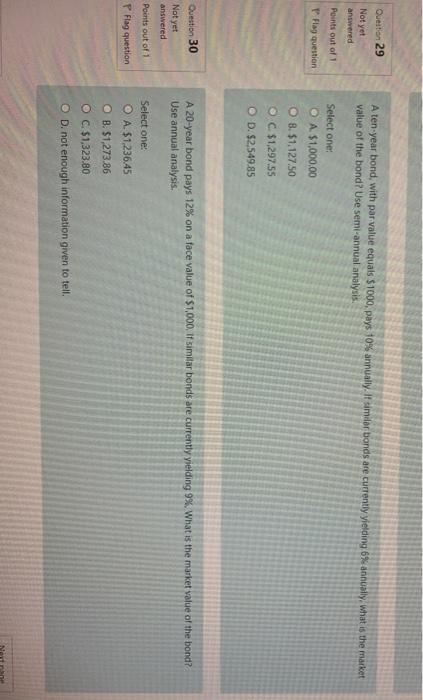

Question: Question 29 Not yet A ten-year bond, with par value equals $1000, pays 10% annually. It similar bonds are currently yielding 6% annually, what is

Question 29 Not yet A ten-year bond, with par value equals $1000, pays 10% annually. It similar bonds are currently yielding 6% annually, what is the market value of the bond? Use semi-annual analysis. answered Points out of 1 Flag question Select one: O A $1,000.00 8. $1,127.50 C$1,297.55 O D. $2.549.85 Question 30 A 20-year bond pays 12% on a face value of $1,000, If similar bonds are currently vielding 9%. What is the market value of the bond? Use annual analysis. Not yet answered Points out of 1 Select one: O A. $1,236.45 P Flag question B. $1,273.86 OC $1,323.80 OD. not enough information given to tell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts