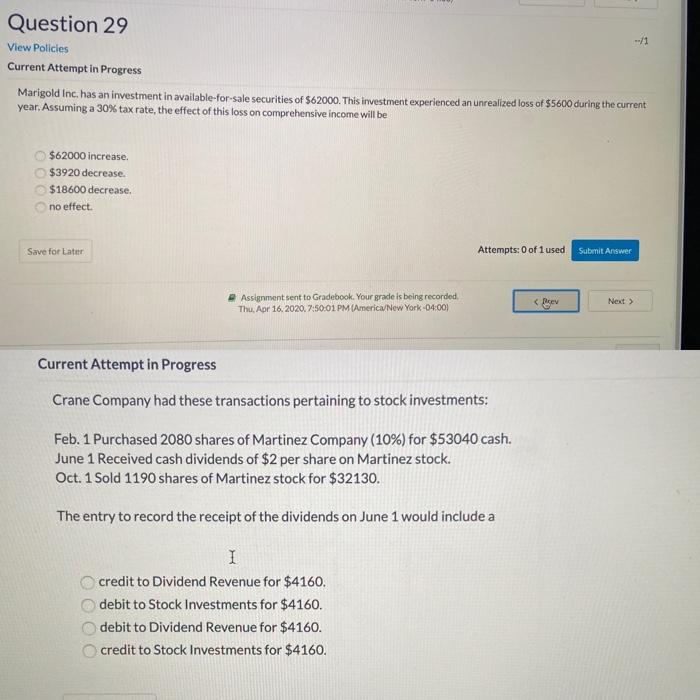

Question: Question 29 View Policies Current Attempt in Progress Marigold Inc. has an investment in available for sale securities of $62000. This investment experienced an unrealized

Question 29 View Policies Current Attempt in Progress Marigold Inc. has an investment in available for sale securities of $62000. This investment experienced an unrealized loss of $5600 during the current year. Assuming a 30% tax rate, the effect of this loss on comprehensive Income will be $62000 increase. $3920 decrease. $18600 decrease no effect Save for Later Attempts: 0 of 1 used Submit Answer Assignment sent to Gradebook. Your grade is being recorded. Thu, Apr 16, 2020, 7:50:01 PM (America/New York-04:00) Next > Current Attempt in Progress Crane Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2080 shares of Martinez Company (10%) for $53040 cash. June 1 Received cash dividends of $2 per share on Martinez stock. Oct. 1 Sold 1190 shares of Martinez stock for $32130. The entry to record the receipt of the dividends on June 1 would include a credit to Dividend Revenue for $4160. debit to Stock Investments for $4160. debit to Dividend Revenue for $4160. credit to Stock Investments for $4160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts