Question: (Question 2)(CAPM, Beta, NPV) (REQUIRED) Mr. Mandeville is considering new project which costs $600,000 initially and will give one-time cashflow of $950,000 two years from

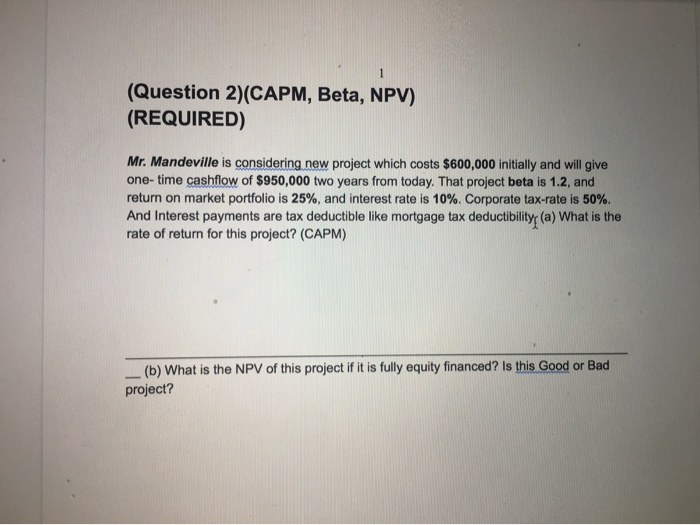

(Question 2)(CAPM, Beta, NPV) (REQUIRED) Mr. Mandeville is considering new project which costs $600,000 initially and will give one-time cashflow of $950,000 two years from today. That project beta is 1.2, and return on market portfolio is 25%, and interest rate is 10%. Corporate tax-rate is 50% And Interest payments are tax deductible like mortgage tax deductibility (a) What is the rate of return for this project? (CAPM) (b) What is the NPV of this project if it is fully equity financed? Is this Good or Bad project? (c) What is the NPV of this project, if he can borrow all $600,000 at 10%? (Use PV of tax shield: Remember you will get tax benefits every-year for two years)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts