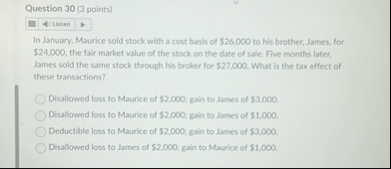

Question: Question 3 0 ( 3 points ) In January, Maurice sold stock with a cost basis of $ 2 6 , 0 0 0 to

Question points

In January, Maurice sold stock with a cost basis of $ to his brother, James, for $ the fair market value of the stock on the date of sale. Five months later, tames sofd the same stock through his brober for What is the tax effect of these transactions?

Disalfowed loss to Maurice of $; gin to James of $

Disallowed loss to Maurice of $; grin to James of $

Deductible loss to Maurice of $; glin to James of $

Disallowed loss to James of $; gain to Maurice of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock