Question: Question 3 0 ( 5 points ) Two companies A and B have the same revenues and expenses and both are subject to taxes at

Question points

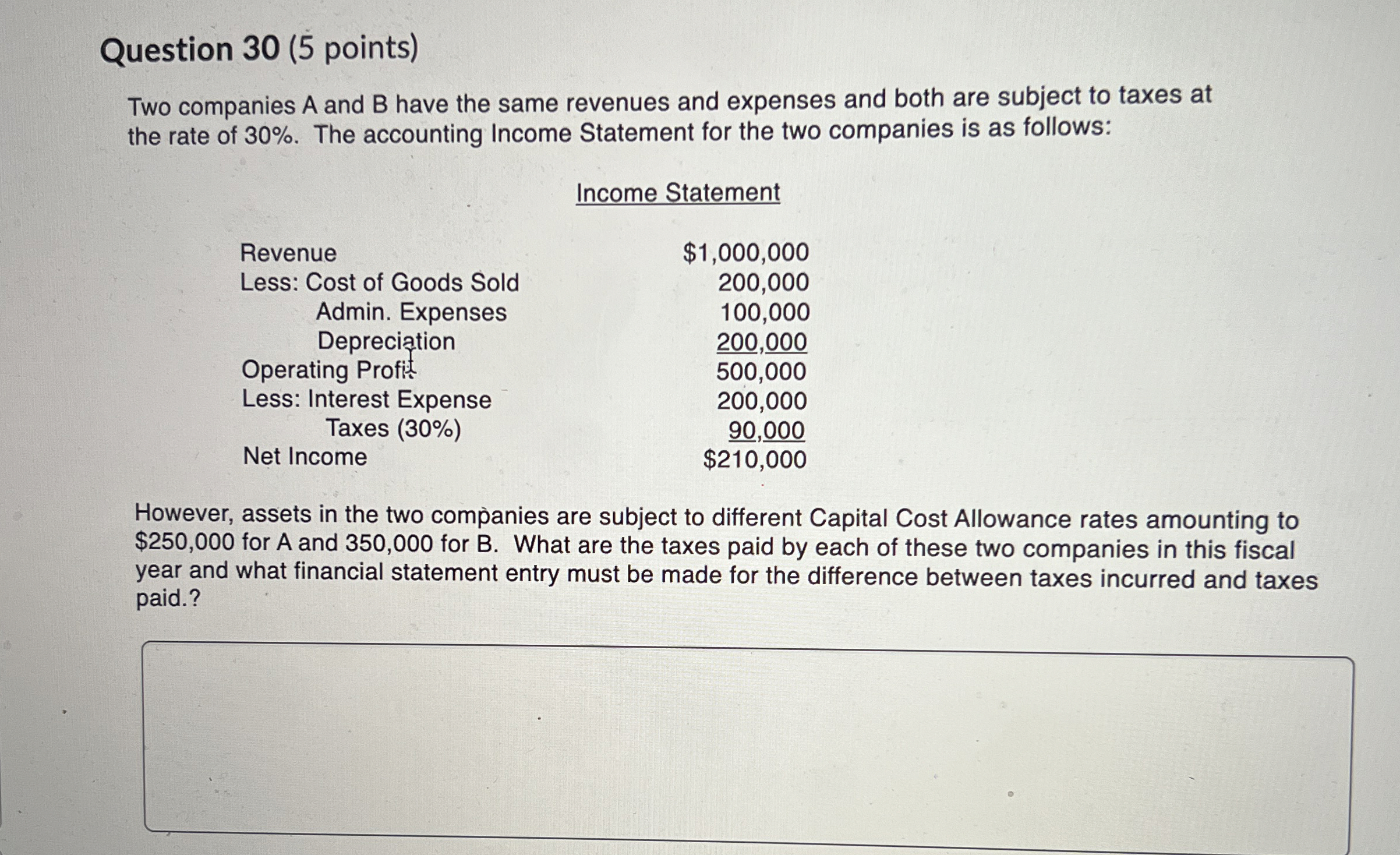

Two companies A and have the same revenues and expenses and both are subject to taxes at the rate of The accounting Income Statement for the two companies is as follows:

tableIncome StatementRevenue$Less: Cost of Goods Sold,Admin Expenses,DepreciationOperating Profit,Less: Interest Expense,Taxes Net Income,$

However, assets in the two companies are subject to different Capital Cost Allowance rates amounting to $ for A and for What are the taxes paid by each of these two companies in this fiscal year and what financial statement entry must be made for the difference between taxes incurred and taxes paid.?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock