Question: Question 3 (06 Marks) a (A) Consider a stock with an initial price of $40, an expected return of 16% per annum and a volatility

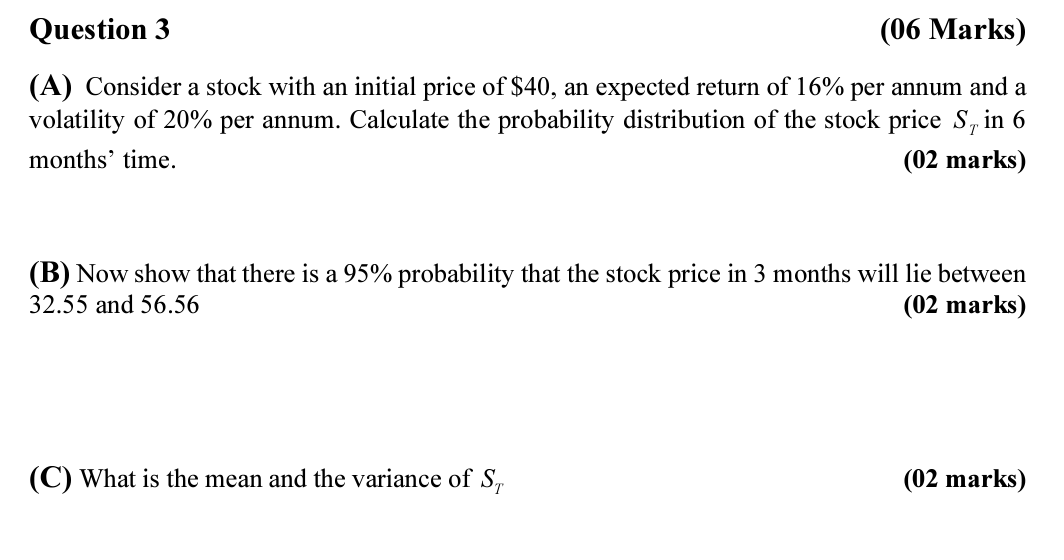

Question 3 (06 Marks) a (A) Consider a stock with an initial price of $40, an expected return of 16% per annum and a volatility of 20% per annum. Calculate the probability distribution of the stock price S, in 6 months' time. (02 marks) (B) Now show that there is a 95% probability that the stock price in 3 months will lie between 32.55 and 56.56 (02 marks) (C) What is the mean and the variance of S, (02 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts