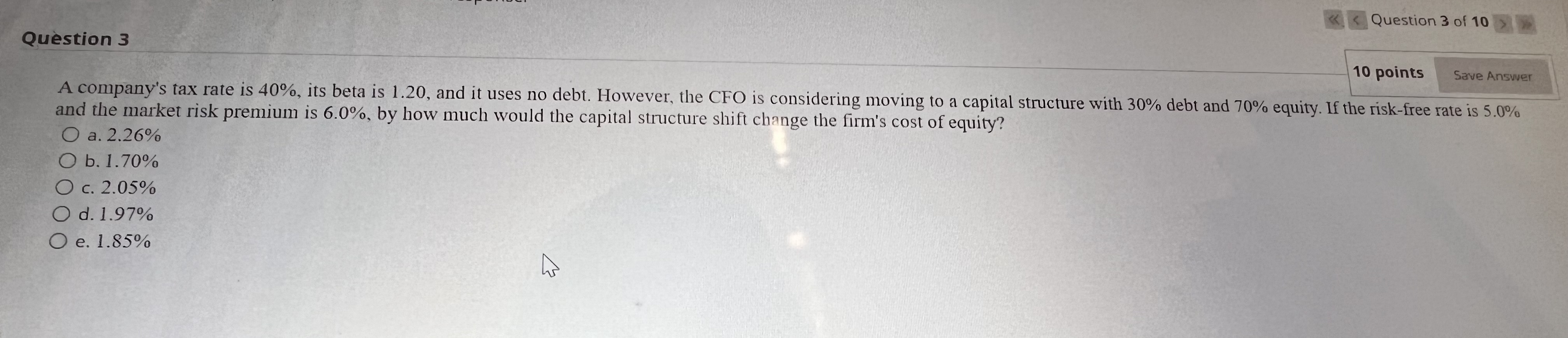

Question: Question 3 1 0 points Save Answer A company's tax rate is 4 0 % , its beta is 1 . 2 0 , and

Question

points

Save Answer

A company's tax rate is its beta is and it uses no debt. However, the CFO is considering moving to a capital structure with debt and equity. If the riskfree rate is and the market risk premium is by how much would the capital structure shift change the firm's cost of equity?

a

b

d

eQuestion

A company's tax rate is its beta is and it uses no debt. However, the CFO is considering moving to a capital structure with debt and equity. If the riskfree rate is

and the market risk premium is by how much would the capital structure shift change the firm's cost of equity?

a

b

c

d

e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock