Question: Question 3 ( 1 3 marks ) Popeye Inc. acquired 4 0 0 , 0 0 0 of the 5 0 0 , 0 0

Question marks

Popeye Inc. acquired of the outstanding common shares of Sailor Limited on July

by issuing of its own common shares with an estimated market value of $ per share

and paying cash of $

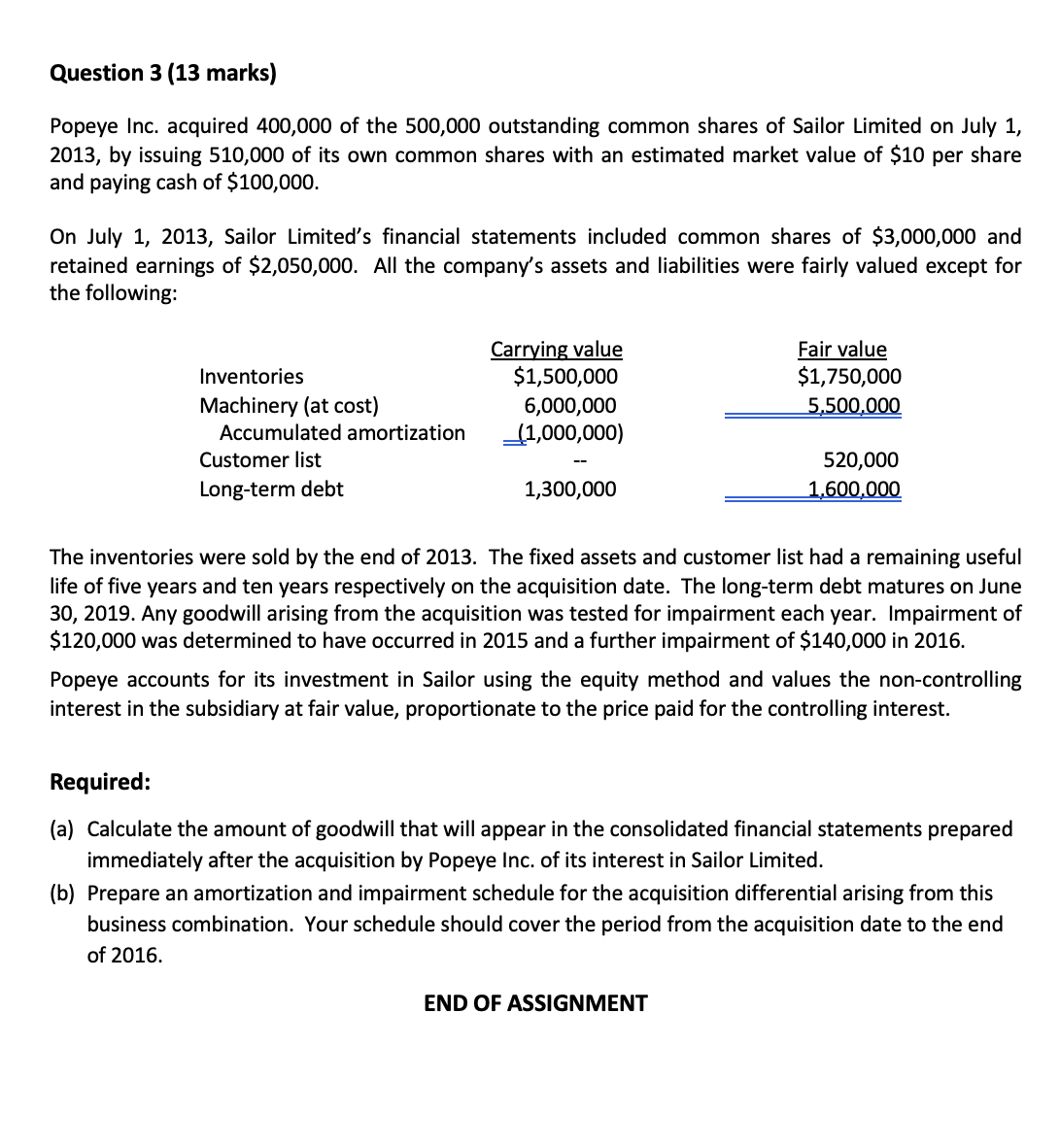

On July Sailor Limited's financial statements included common shares of $ and

retained earnings of $ All the company's assets and liabilities were fairly valued except for

the following:

The inventories were sold by the end of The fixed assets and customer list had a remaining useful

life of five years and ten years respectively on the acquisition date. The longterm debt matures on June

Any goodwill arising from the acquisition was tested for impairment each year. Impairment of

$ was determined to have occurred in and a further impairment of $ in

Popeye accounts for its investment in Sailor using the equity method and values the noncontrolling

interest in the subsidiary at fair value, proportionate to the price paid for the controlling interest.

Required:

a Calculate the amount of goodwill that will appear in the consolidated financial statements prepared

immediately after the acquisition by Popeye Inc. of its interest in Sailor Limited.

b Prepare an amortization and impairment schedule for the acquisition differential arising from this

business combination. Your schedule should cover the period from the acquisition date to the end

of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock