Question: Question 3 (1 point) A proposed open-pit mine would require an investment of $2 million at the beginning of the first year. Mining operations are

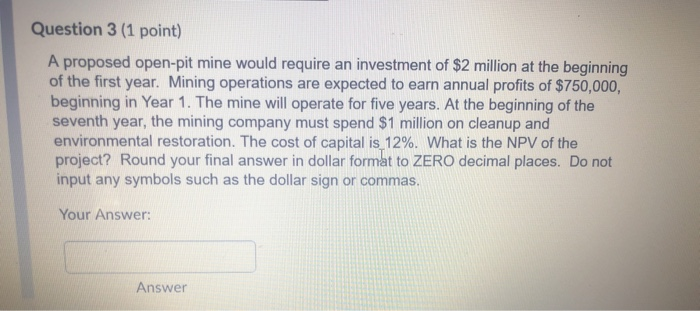

Question 3 (1 point) A proposed open-pit mine would require an investment of $2 million at the beginning of the first year. Mining operations are expected to earn annual profits of $750,000, beginning in Year 1. The mine will operate for five years. At the beginning of the seventh year, the mining company must spend $1 million on cleanup and environmental restoration. The cost of capital is 12%. What is the NPV of the project? Round your final answer in dollar format to ZERO decimal places. Do not input any symbols such as the dollar sign or commas. Your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock