Question: Question 3 (1 point) Basic earning power: measures the rate of return on the stockholders investment. measures the return on the firms assets after interest

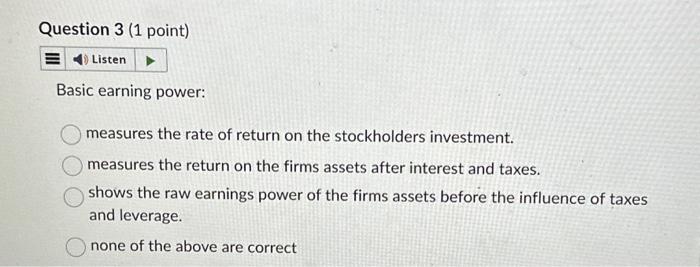

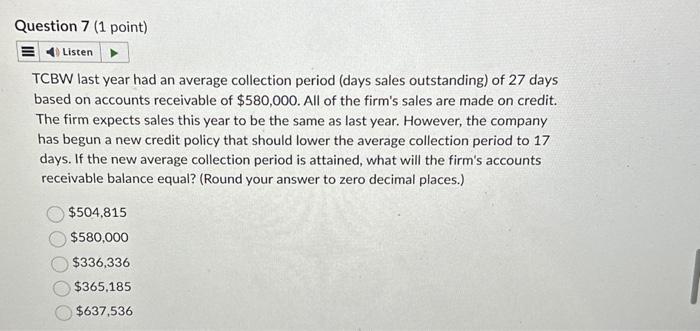

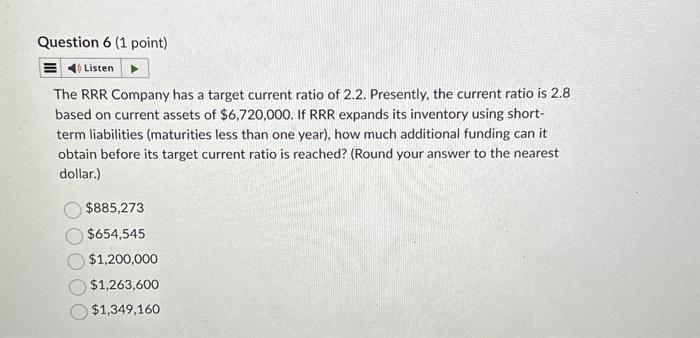

Question 3 (1 point) Basic earning power: measures the rate of return on the stockholders investment. measures the return on the firms assets after interest and taxes. shows the raw earnings power of the firms assets before the influence of taxes and leverage. none of the above are correct TCBW last year had an average collection period (days sales outstanding) of 27 days based on accounts receivable of $580,000. All of the firm's sales are made on credit. The firm expects sales this year to be the same as last year. However, the company has begun a new credit policy that should lower the average collection period to 17 days. If the new average collection period is attained, what will the firm's accounts receivable balance equal? (Round your answer to zero decimal places.) $504,815 $580,000 $336,336 $365,185 $637,536 The RRR Company has a target current ratio of 2.2. Presently, the current ratio is 2.8 based on current assets of $6,720,000. If RRR expands its inventory using shortterm liabilities (maturities less than one year), how much additional funding can it obtain before its target current ratio is reached? (Round your answer to the nearest dollar.) $885,273 $654,545 $1,200,000 $1,263,600 $1,349,160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts