Question: Question 3 (1 point) Find the Net Present Value (NPV) of a project that has cash flows of -12000 in Year 1 (that is the

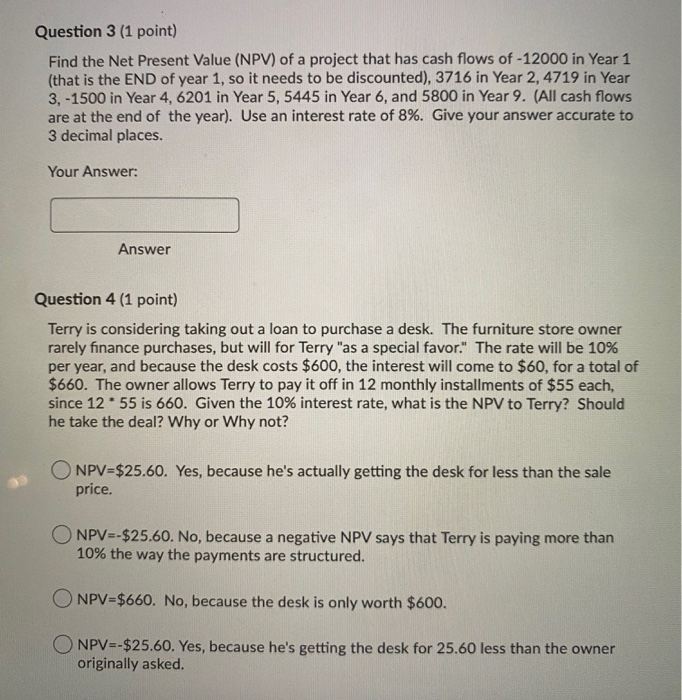

Question 3 (1 point) Find the Net Present Value (NPV) of a project that has cash flows of -12000 in Year 1 (that is the END of year 1, so it needs to be discounted), 3716 in Year 2, 4719 in Year 3, -1500 in Year 4, 6201 in Year 5, 5445 in Year 6, and 5800 in Year 9. (All cash flows are at the end of the year). Use an interest rate of 8%. Give your answer accurate to 3 decimal places. Your Answer: Answer Question 4 (1 point) Terry is considering taking out a loan to purchase a desk. The furniture store owner rarely finance purchases, but will for Terry "as a special favor." The rate will be 10% per year, and because the desk costs $600, the interest will come to $60, for a total of $660. The owner allows Terry to pay it off in 12 monthly installments of $55 each, since 12 * 55 is 660. Given the 10% interest rate, what is the NPV to Terry? Should he take the deal? Why or Why not? NPV=$25.60. Yes, because he's actually getting the desk for less than the sale price. ONPV=-$25.60. No, because a negative NPV says that Terry is paying more than 10% the way the payments are structured. O NPV=$660. No, because the desk is only worth $600. O NPV=-$25.60. Yes, because he's getting the desk for 25.60 less than the owner originally asked

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts