Question: Question 3 (1 point) Ivan uses the TVM Solver to estimate the monthly payment for his mortgage. The TVM Solver shows these settings: N=240, 1%=5.1,

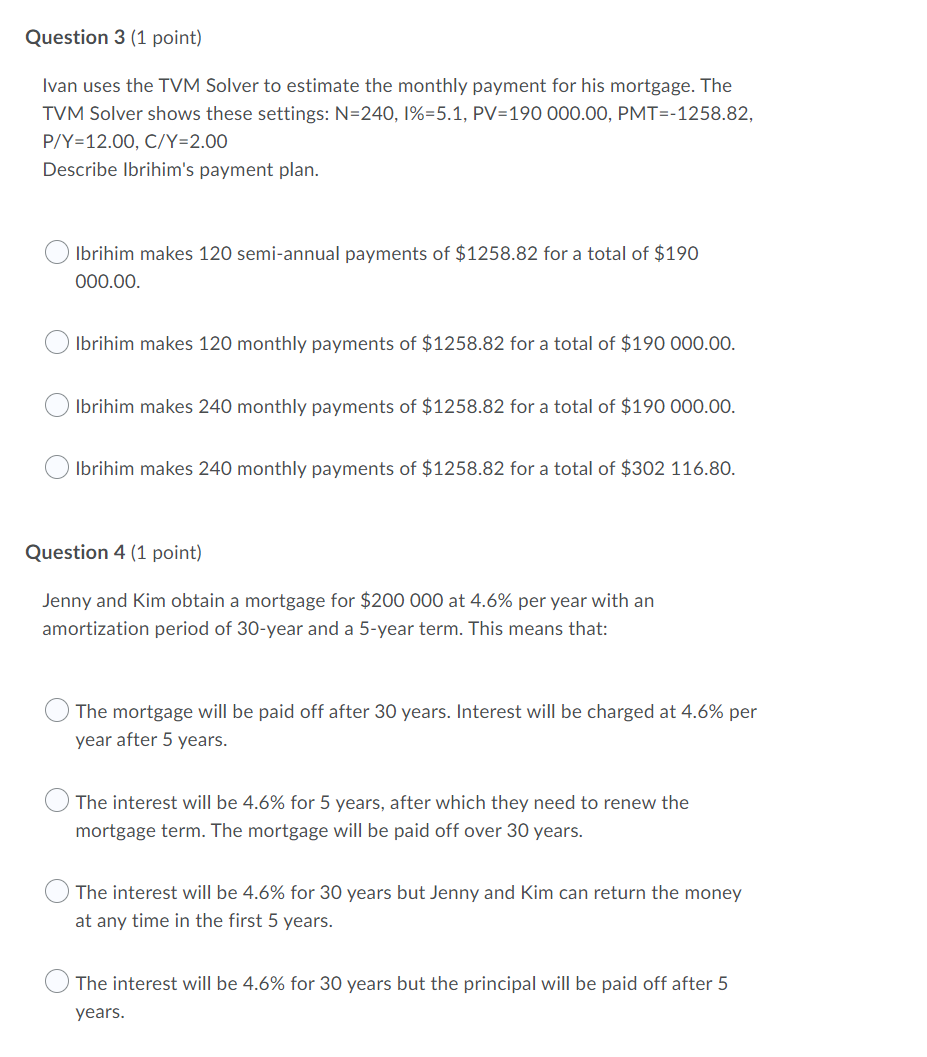

Question 3 (1 point) Ivan uses the TVM Solver to estimate the monthly payment for his mortgage. The TVM Solver shows these settings: N=240, 1%=5.1, PV=190 000.00, PMT=-1258.82, P/Y=12.00, C/Y=2.00 Describe Ibrihim's payment plan. Ibrihim makes 120 semi-annual payments of $1258.82 for a total of $190 000.00. O Ibrihim makes 120 monthly payments of $1258.82 for a total of $190 000.00. O Ibrihim makes 240 monthly payments of $1258.82 for a total of $190 000.00. Ibrihim makes 240 monthly payments of $1258.82 for a total of $302 116.80. Question 4 (1 point) Jenny and Kim obtain a mortgage for $200 000 at 4.6% per year with an amortization period of 30-year and a 5-year term. This means that: The mortgage will be paid off after 30 years. Interest will be charged at 4.6% per year after 5 years. The interest will be 4.6% for 5 years, after which they need to renew the mortgage term. The mortgage will be paid off over 30 years. The interest will be 4.6% for 30 years but Jenny and Kim can return the money at any time in the first 5 years. The interest will be 4.6% for 30 years but the principal will be paid off after 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts