Question: Question 3 (1 point) Saved Suppose you buy a zero coupon bond with face value $10, and a bull spread i.e. the combination of a

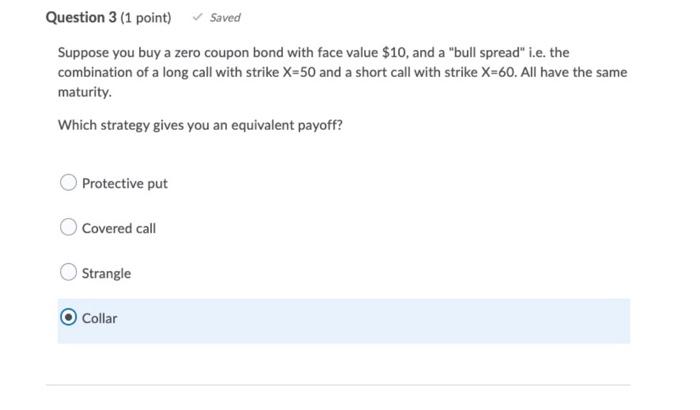

Question 3 (1 point) Saved Suppose you buy a zero coupon bond with face value $10, and a "bull spread" i.e. the combination of a long call with strike X=50 and a short call with strike X=60. All have the same maturity. Which strategy gives you an equivalent payoff? Protective put Covered call Strangle Collar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts