Question: Question 3 1 points Saved Which statement regarding the efficient markets hypothesis is true? If a market is strong-form efficient, this implies that the returns

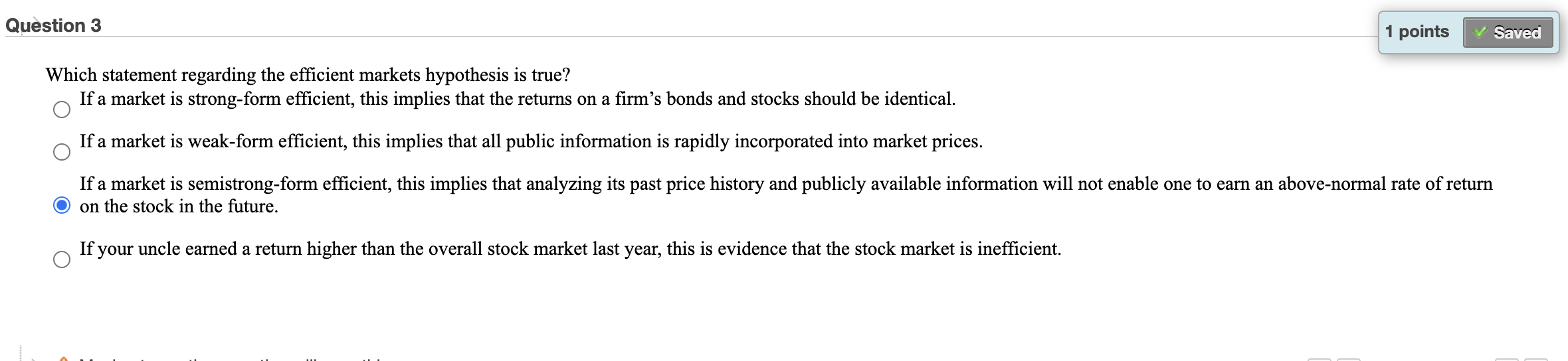

Question 3 1 points Saved Which statement regarding the efficient markets hypothesis is true? If a market is strong-form efficient, this implies that the returns on a firm's bonds and stocks should be identical. If a market is weak-form efficient, this implies that all public information is rapidly incorporated into market prices. If a market is semistrong-form efficient, this implies that analyzing its past price history and publicly available information will not enable one to earn an above-normal rate of return on the stock in the future. If your uncle earned a return higher than the overall stock market last year, this is evidence that the stock market is inefficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts