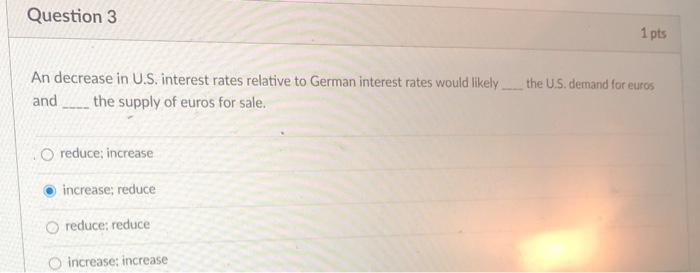

Question: Question 3 1 pts An decrease in U.S. interest rates relative to German interest rates would likely the U.S. demand for euros and the supply

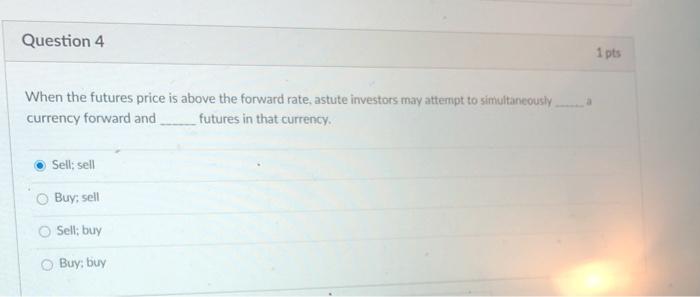

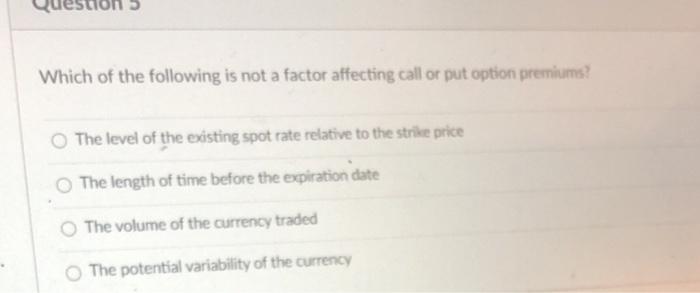

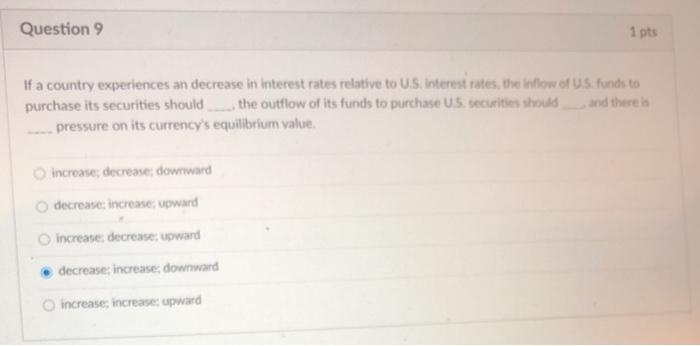

Question 3 1 pts An decrease in U.S. interest rates relative to German interest rates would likely the U.S. demand for euros and the supply of euros for sale. O reduce; increase increase; reduce reduce; reduce increase: increase Question 4 1 pts When the futures price is above the forward rate, astute investors may attempt to simultaneously currency forward and futures in that currency Sell; sell Buy, sell Sell buy Buy: buy destion > Which of the following is not a factor affecting call or put option premiums? The level of the existing spot rate relative to the strike price The length of time before the expiration date The volume of the currency traded The potential variability of the currency Question 9 1 pts If a country experiences an decrease in interest rates relative to U.S. Interest rates, the flow of US funds to purchase its securities should the outflow of its funds to purchase US. securities should and there pressure on its currency's equilibrium value. increase; decrease downward decrease increase upward increase decrease upward decrease increase downward increase increase upward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts