Question: Question 3 1 pts JAN Corp. will pay a dividend of $ 3.00 per share one year from now and a dividend of $ 3.20

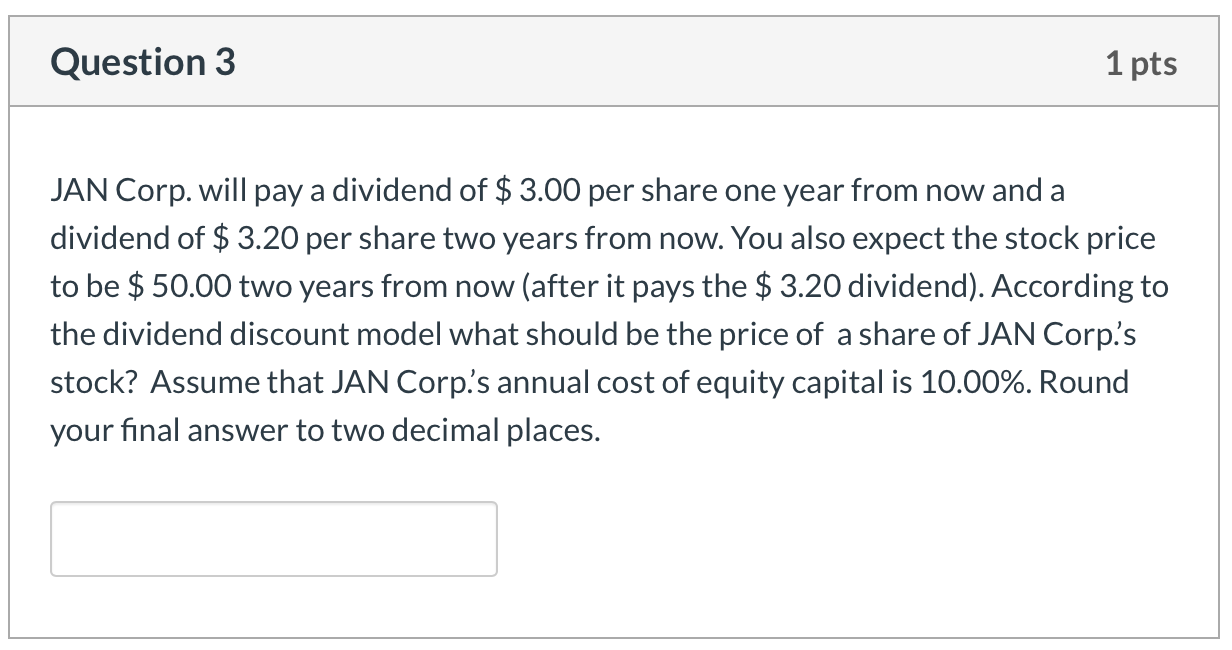

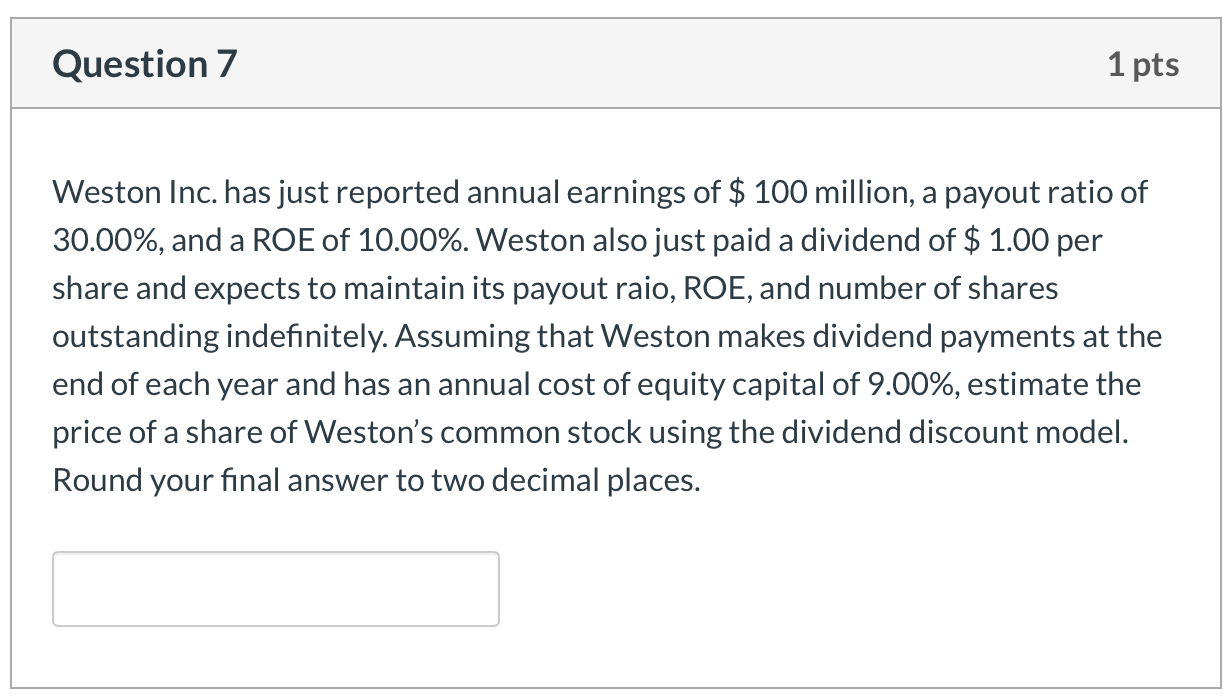

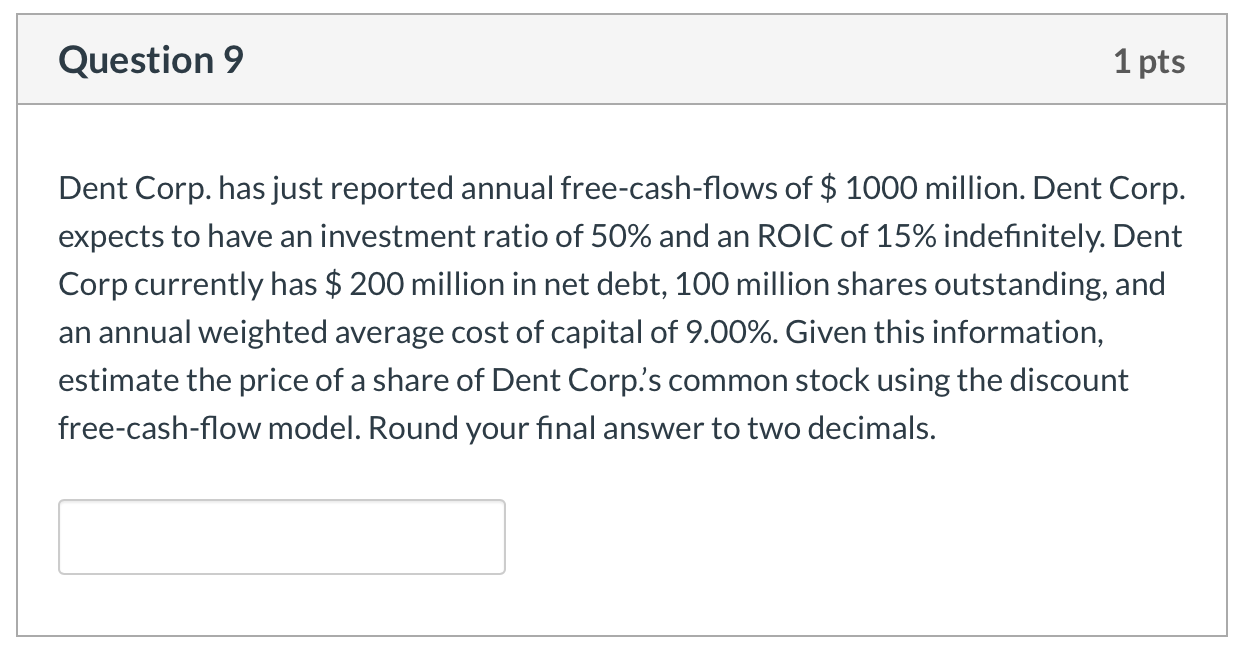

Question 3 1 pts JAN Corp. will pay a dividend of $ 3.00 per share one year from now and a dividend of $ 3.20 per share two years from now. You also expect the stock price to be $ 50.00 two years from now (after it pays the $ 3.20 dividend). According to the dividend discount model what should be the price of a share of JAN Corp.'s stock? Assume that JAN Corps annual cost of equity capital is 10.00%. Round your final answer to two decimal places. Question 7 1 pts Weston Inc. has just reported annual earnings of $ 100 million, a payout ratio of 30.00%, and a ROE of 10.00%. Weston also just paid a dividend of $ 1.00 per share and expects to maintain its payout raio, ROE, and number of shares outstanding indefinitely. Assuming that Weston makes dividend payments at the end of each year and has an annual cost of equity capital of 9.00%, estimate the price of a share of Weston's common stock using the dividend discount model. Round your final answer to two decimal places. Question 9 1 pts Dent Corp. has just reported annual free-cash-flows of $ 1000 million. Dent Corp. expects to have an investment ratio of 50% and an ROIC of 15% indefinitely. Dent Corp currently has $ 200 million in net debt, 100 million shares outstanding, and an annual weighted average cost of capital of 9.00%. Given this information, estimate the price of a share of Dent Corp's common stock using the discount free-cash-flow model. Round your final answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts