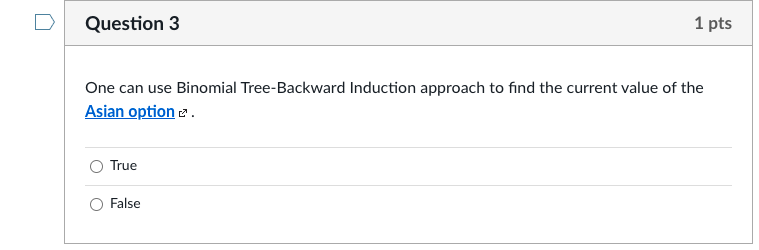

Question: Question 3 1 pts One can use Binomial Tree-Backward Induction approach to find the current value of the Asian option 2. True False Question 4

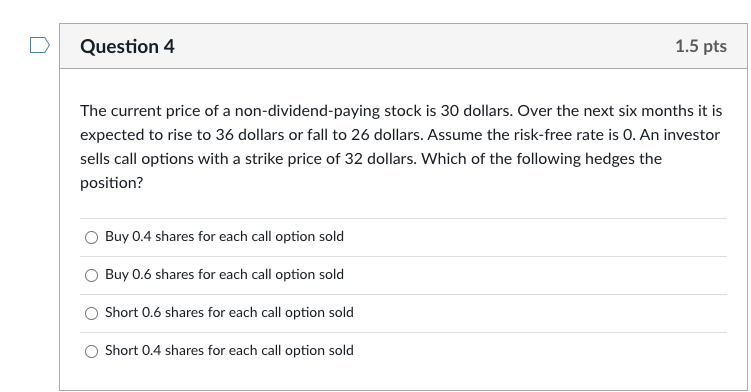

Question 3 1 pts One can use Binomial Tree-Backward Induction approach to find the current value of the Asian option 2. True False Question 4 1.5 pts The current price of a non-dividend-paying stock is 30 dollars. Over the next six months it is expected to rise to 36 dollars or fall to 26 dollars. Assume the risk-free rate is 0. An investor sells call options with a strike price of 32 dollars. Which of the following hedges the position? Buy 0.4 shares for each call option sold Buy 0.6 shares for each call option sold Short 0.6 shares for each call option sold Short 0.4 shares for each call option sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts