Question: Question 3 1 pts Question 4 1 pts Prices for American calls with strike prices 128, 156, and 182 are provided below. Prices for American

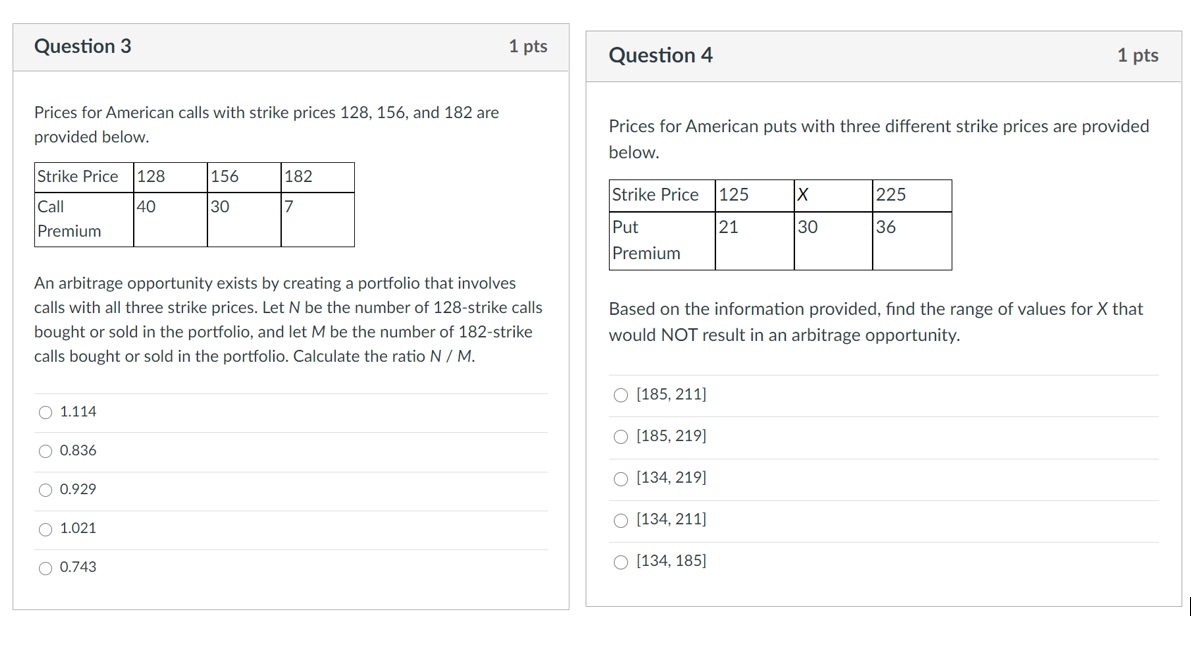

Question 3 1 pts Question 4 1 pts Prices for American calls with strike prices 128, 156, and 182 are provided below. Prices for American puts with three different strike prices are provided below. Strike Price 128 156 182 Strike Price 125 X 225 Call 40 30 7 Premium Put 21 30 36 Premium An arbitrage opportunity exists by creating a portfolio that involves calls with all three strike prices. Let N be the number of 128-strike calls bought or sold in the portfolio, and let M be the number of 182-strike calls bought or sold in the portfolio. Calculate the ratio N/M. Based on the information provided, find the range of values for X that would NOT result in an arbitrage opportunity. O [185, 211] O 1.114 O [185, 219] O 0.836 O (134, 219] O 0.929 O (134, 211] 01.021 O 0.743 O [134, 185] Question 3 1 pts Question 4 1 pts Prices for American calls with strike prices 128, 156, and 182 are provided below. Prices for American puts with three different strike prices are provided below. Strike Price 128 156 182 Strike Price 125 X 225 Call 40 30 7 Premium Put 21 30 36 Premium An arbitrage opportunity exists by creating a portfolio that involves calls with all three strike prices. Let N be the number of 128-strike calls bought or sold in the portfolio, and let M be the number of 182-strike calls bought or sold in the portfolio. Calculate the ratio N/M. Based on the information provided, find the range of values for X that would NOT result in an arbitrage opportunity. O [185, 211] O 1.114 O [185, 219] O 0.836 O (134, 219] O 0.929 O (134, 211] 01.021 O 0.743 O [134, 185]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts